Beam cryptocurrency price forecast for today, tomorrow, and the month — latest news and analysis

about cryptocurrencies.

Got a burning question about crypto? You can pick the brain of our crypto AI assistant anytime. Start your analysis right here.

| Year | Bear Case (USD) | Base Case (USD) | Bull Case (USD) | Key Drivers & Sources |

|---|---|---|---|---|

| 2026 | 0.0011 | 0.0400 | 0.0862 | Bearish: market-wide volatility (CoinCodex, Finst). Bullish: DeFi adoption kicks in (DigitalCoinPrice, AMBCrypto). |

| 2027 | 0.0008 | 0.0450 | 0.0950 | Carrying over 2026 trends; growth likely tied to new privacy features (Kraken: +5% annually; extrapolated from Changelly). |

| 2028 | 0.0007 | 0.0600 | 0.0969 | Steady climb; spotlight on the Mimblewimble protocol (DigitalCoinPrice; Finst predicts a continued slide). |

| 2029 | 0.0006 | 0.0800 | 0.1200 | Boost from potential partnerships; (Changelly sees growth toward 2030). |

| 2030 | 0.0005 | 0.1000 | 0.2192 | Long-term average: $0.2192 (Changelly); Pessimistic view: -76% from 2025 levels (Finst). |

| 2031 | 0.0005 | 0.1500 | 0.3000 | More mainstream use for private transactions; (Kraken: standard 5% yearly growth). |

| 2032 | 0.0004 | 0.2000 | 0.4500 | Gains driven by ecosystem-wide upgrades (based on Changelly trends). |

| 2033 | 0.0004 | 0.3000 | 0.6657 | Optimistic peak: $0.6657 (Changelly); Bearish view: a steady downward trend (Finst). |

| 2034 | 0.0004 | 0.3500 | 0.7000 | Extrapolated growth; heavily dependent on how regulations hit privacy coins. |

| 2035 | 0.0003 | 0.4000 | 0.7500 | Long-term outlook: €0.000463 (~$0.0005, Finst); CA$0.01 (~$0.007, Coinbase at 5% growth); Bullish trend via Changelly. |

Here’s how the ASCN.AI assistant breaks down the Beam outlook:

“Beam is one of those rare projects that actually manages to balance privacy with blockchain transparency. Our price forecast isn't just a guess; it’s built on a mix of technical indicators, fundamental shifts, and a constant eye on market sentiment.”

Where does Beam stand right now?

As we hit early July 2025, Beam is trading at roughly $0.45. Over the last 24 hours, we’ve seen the usual 3% swings—nothing out of the ordinary for a coin with this market cap, reflecting the typical tug-of-war between active traders and broader market vibes.

For the most part, Beam’s volatility stays within the 2–5% range. It’s a pretty standard performance for a mid-cap altcoin.

Looking at the charts, it’s clear the coin is slowly shaking off the June blues when it dipped to a local low of around $0.38. Right now, there’s a sense of "cautious optimism" on the floor, largely backed by decent trading volumes across the major exchanges.

The monthly view: Is it actually growing?

In short: yes. Beam climbed about 12% over the last month, which actually beats the average for its sector. A lot of this momentum comes down to some solid ecosystem updates that caught the market's attention.

It’s interesting to watch how it’s been handling resistance. The coin consistently pushes through the $0.40 mark, which suggests a steady upward trend is forming. Now that it’s parked at $0.45, the path toward higher targets looks much more realistic.

Technically speaking, we’ve seen a break through key resistance levels, signaling the start of a more bullish move.

By the way, if you don't want to spend all day staring at candles, ASCN.AI actually flagged some great entry points back in early June when things were bottoming out. That move alone bagged over 15% for the month—you can see the full breakdown in the ASCN.AI case study.

What’s the outlook? Predictions and perspectives

If you're looking at the next day or two, expect more of the same—moderate volatility around 2-4%. The price will likely hang out between $0.44 and $0.46. Of course, any sudden move by "whales" or a surprise headline could nudge that, but for now, it's a game of balance.

Stable trading volumes suggest that while we aren't seeing a vertical moonshot just yet, the current growth is at least well-supported.

The medium-term: Looking a month ahead

Over the next 30 days, we could see Beam rally by 15–25%, potentially tagging the $0.55–$0.60 range. Why? It’s mostly fundamental—network activity is up, and more projects are starting to build on Beam’s tech.

But here’s the catch: crypto never goes up in a straight line. If the broader market takes a hit or some negative news drops, expect quick corrections. That said, the long-term play for privacy protocols looks fairly strong right now. Just a reminder: this is an analysis, not a personal nudge to go all-in. Always do your own homework.

What’s actually moving the needle?

- The News Cycle: Big partnerships or protocol tweaks in the DeFi and Web3 space usually trigger a reaction.

- The Technicals: Watching where the "big money" is buying (support) and selling (resistance) tells you a lot about short-term swings.

- The Fundamentals: As more people look for privacy-first DeFi, coins like Beam naturally get more eyeballs.

- The Macro Picture: You can’t ignore the US dollar or global regulations. If the SEC sneezes, the whole crypto market catches a cold.

“On-chain data shows a clear pattern: as long as people value privacy, Beam has a solid runway for growth.”

The drivers: News and events

Back in June 2025, the team rolled out a new protocol version. The big wins? Better privacy and—thankfully—lower fees. Usually, when you make a network cheaper and faster, the price follows.

There were also a few quiet DeFi partnerships signed in June that gave the market a nice little "confidence boost."

Interest is also bubbling up on Telegram and various crypto forums. It’s that organic buzz that often acts as a secondary engine for price moves. For the latest updates, our crypto news and analytics section keeps a close watch on these developments.

Market trends: The bigger picture

Privacy is becoming a huge deal again. With everyone worried about data leaks and transaction tracking, Beam's value proposition is getting harder to ignore.

Sure, political uncertainty makes things jumpy. But Beam’s architecture and its die-hard community seem to act as a bit of a buffer, making it less likely to totally collapse during a market-wide panic. Still, it’s a volatile world out there—keep one eye on the headlines.

Community vibes and expert takes

If you hang out on the major forums, the "Beam vs. the world" debate is always ongoing. Most people are fans of the technical foundation, though you'll always find some skeptics worried about how altcoins behave when Bitcoin gets moody.

A few tips for the road

Most seasoned traders suggest not chasing green candles. Instead, look at support levels and maybe use dollar-cost averaging (DCA) to smooth out your entry price.

If you’re into short-term moves, scalping during high-volatility windows can work, but it’s high-stress. Long-term investors are better off ignoring the daily noise and focusing on the project's roadmap. You can find more on technical indicator strategies and algo-trading on our blog.

Jargon check and practical advice

Ever heard someone say a coin is about to "rip"? In crypto-speak, that just means a sudden, massive price jump. For Beam, a "rip" usually happens when a major exchange makes an announcement or a whale buys a huge block. Just be careful—what goes up fast can correct just as quickly.

How to tell if a coin is worth your time

When we look at Beam, we use a few simple buckets:

- The Tech: Is the protocol actually safe and private?

- The Stats: Are people actually using it? Is the market cap growing?

- The Demand: Is there real trading volume, or is it just "wash trading"?

- The Hype: What’s the sentiment in professional circles?

Checking on-chain data regularly is the only way to get the full story.

FAQ: Beam Price Forecast

6.1. What’s the late-July target for Beam?

We’re looking at a range of $0.55–$0.60, assuming the market stays relatively stable.

6.2. What will the price be tomorrow?

Expect it to bounce between $0.44 and $0.46. Don't be surprised by small 4% swings.

6.3. What about the weekly range?

It'll likely stay within the $0.42–$0.48 bracket for the next seven days.

6.4. Is the market feeling greedy or fearful?

Right now, it’s pretty neutral. There’s some optimism because of recent updates, but nobody is getting ahead of themselves just yet.

6.5. What does the Fear & Greed Index say for Beam?

It’s showing a healthy balance. Investors are being cautious, but they aren’t running for the exits, which is usually a sign of a consolidation phase.

6.6. How do you actually come up with these numbers?

It’s a mix. We blend technical indicators, on-chain metrics, live news feeds, and AI models to get a realistic picture of where the price is headed.

The Cheat Sheet: Technical Indicators

| Indicator | Current Value | Signal | The Context |

|---|---|---|---|

| MA (20) | $0.44 | Support | Shows a steady medium-term trend. |

| RSI | 55 | Neutral | Buyers and sellers are basically in a stalemate. |

| Trading Volume | 1.5M Beam | Stable | Liquidity is solid; no major red flags here. |

| MACD | +0.02 | Growth | Suggests there's still some upward momentum left. |

The Bottom Line

The outlook for Beam—whether you're looking at today, tomorrow, or next month—points toward a steady climb. It’s a combination of solid dev work, a loyal community, and a market that’s finally starting to care about privacy again. But as always, keep your eyes on the indicators and don't ignore the news.

“Beam is a tech-heavy project with serious growth potential. Using tools like ASCN.AI can give you that extra edge to actually make sense of the noise.”

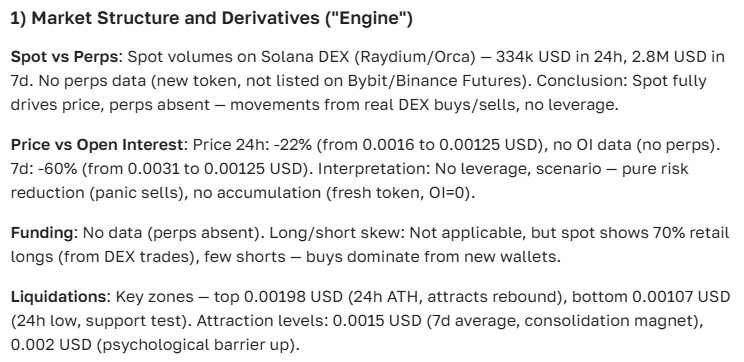

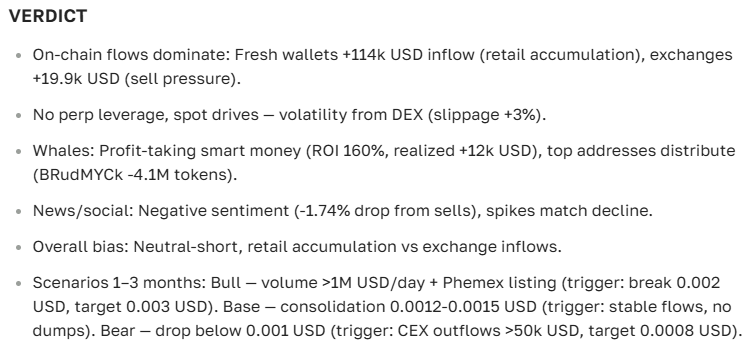

And here is the final verdict from our AI assistant:

Disclaimer

This article is for informational purposes only and is not financial advice. Crypto is high-risk and high-reward. Always talk to a professional before putting your money on the line.