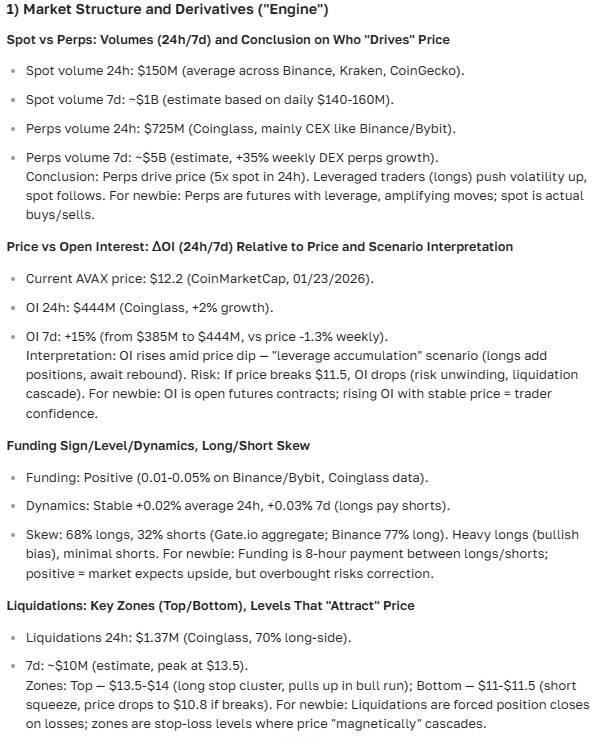

Avalanche cryptocurrency forecast for 2025-2035: prices, prospects, and news

about cryptocurrencies.

Got a crypto question? Hit up our crypto AI assistant anytime. Jump into the analysis now.

| Year | Price Range (USD) | Avg Price (USD) | What's Driving It (and the Risks) |

|---|---|---|---|

| 2026 | $12 – $114 | ~$50 | Post-2025 rally kicks off; Durango upgrade rolls out, DeFi TVL jumps 50%. But watch for BTC peak pullback, SEC regs tightening, L1 rivals crowding in. |

| 2027 | $20 – $130 | ~$70 | Subnets expand big time; RWA tokenization and NFTs pick up steam. Risks? Geopolitics heating up, network hiccups like back in '21. |

| 2028 | $30 – $150 | ~$90 | Synergy with BTC halving; banks jump on board, Avalanche9000 drops. Downside: EU's MiCA rules, validator centralization whispers. |

| 2029 | $40 – $160 | ~$100 | Cycle peak hits; TVL tops $5B, big institutions dive into DeFi. Watch for crypto winter chills, subnet fragmentation. |

| 2030 | $63 – $257 | ~$150 | Ecosystem matures; AI/RWA mashups, cap over $50B. Threats from alt L1s like Sui, quantum computing lurking. |

| 2031 | $70 – $200 | ~$130 | Transition phase; fiat inflation pushes adoption in emerging markets. Global crises or shifts to more decentralized L1s could sting. |

| 2032 | $80 – $220 | ~$150 | New halving cycle; global standards lock in, PoS tweaks. Energy use low anyway, but network audits matter. |

| 2033 | $90 – $250 | ~$170 | Bull peak; 30%+ RWA on AVAX. Ecosystem hacks or G20 regs could derail it. |

| 2034 | $100 – $280 | ~$190 | Consolidation mode; scalability hits 10k+ TPS, metaverses boom. Market saturation, devs drifting away? |

| 2035 | $117 – $300 | ~$200 | Institutional takeover in RWA/DeFi. Tech shifts or fresh protocols steal the show. |

Our crypto AI at ASCN.AI crunched these numbers for you.

Avalanche stands out in the crypto crowd – a blockchain platform blending scalability, solid security, and dirt-cheap fees. It powers dApps with lightning-fast transactions that actually feel smooth. No wonder AVAX draws traders looking for real utility.

Avalanche Basics

What's Avalanche, Anyway?

Avalanche is this next-gen blockchain built for dApps and finance apps that need speed without skimping on safety. AVAX, the main token, covers fees, staking, and governance votes – straightforward stuff.

At its core? Avalanche Consensus – a mechanism that greenlights transactions in seconds for pennies. Beats most rivals hands down. That's why devs flock here for DeFi, NFTs, Web3 gigs. In practice, it means fewer headaches building on chain.

The ecosystem? Keeps growing – more active wallets, bigger transaction volumes. Surprisingly resilient.

AVAX Price Right Now

Today's USD Price and Trends

AVAX hovers around $12-13 today, bouncing $12-$14 lately. Up nearly 10% last month amid network buzz. Volatility's crypto normal, but key supports hold – good entry for newbies or vets alike.

AVAX Price Outlook

Market News Impact

Forecasts pull from on-chain data, news, macro vibes. Institutional cash flowing in, partnerships stacking up – all bullish for AVAX. But here's the thing: short-term swings tie to trading volume and headlines.

Next few weeks? Could push past resistance if momentum holds. Updates like Granite keep investors hooked. Overall uptrend, though macro noise might jitter it.

ASCN.AI's news blog – handy for staying ahead without the noise.

Tech and Fundamentals Breakdown

Market cap sits near $4-6B, top-20 territory. ASCN.AI data backs the project's staying power.

Tech-wise, $12-14 support, $18 resistance. Break that? Eyes on $20+. Fundamentals shine with user growth, tx volume up – ecosystem's alive.

Deeper dive on indicators? Check our guide: «Best Strategies for Technical Indicators».

As of late Dec 2025:

- RSI (14) at 39 – neutral ground;

- MACD positive (0.04) – growth hints;

- 50-day SMA ~$14.27, 200-day $21.12;

- Momentum (10) -1.33 – slight dip.

Short-Term Calls (Tomorrow, Month)

Tomorrow: $12-14 range, news and macro dictating. Market moods shift fast.

Month out: Gradual climb to $18, fueled by new projects, liquidity bumps. Break $18? Fresh money pours in.

Growth Potential (and What "Rip" Means)

"Rip" in crypto slang? Sudden price spike up or down. AVAX could rip on tech wins, demand surge.

Risks real though – volatility, outages, macro shifts, L1 wars. Diversify, set stops, watch news. Crypto's wild mix demands caution.

News and Buzz

Latest Chatter on Forums

Fresh partnerships in DeFi/NFT bolster AVAX. Forums buzz with protocol updates – community sentiment? Mostly upbeat.

Investor Tips

Buy AVAX? Here's the Take

Solid for long-haul if you buy the ecosystem story. Tech signals and growth line up for upside.

Mid-term traders: Mind the swings, use stops to cap downside.

FAQ

What’s "Rip" in Crypto?

Sharp, quick price jump – up or down.

How’s the Price Forecast Made?

Charts, fundamentals, news, macros – all in the mix.

AVAX Buy Risks?

Volatility, tech glitches, regs, market chaos. Manage smart.

Dollar and Market Effects on AVAX

AVAX tracks USD strength – strong dollar squeezes crypto. BTC moves and trader vibes amplify it.

Eye econ data for clues on swings.

ASCN.AI Wins in Action

ASCN.AI nailed Falcon Finance (FF) spikes – users reacted fast, cut losses. Same tech tracks AVAX for key insights.

Wrapping Up

AVAX outlook stays bright – cap steady, ecosystem humming, signals green. Track levels, news for smart plays.

Risk-aware, data-driven, full analysis ups your odds.

„Avalanche grows on tech smarts and market fit – prime investor setup“

That's the call from ASCN.AI's crypto AI.

Investor Checklist

- Set your time horizon – long-term shines for AVAX.

- Watch support ($12) and resistance ($18+).

- Stops to limit losses.

- News and ecosystem updates – daily check.

- Diversify that portfolio.

- Tools like ASCN.AI for edge.

Disclaimer

This is info only – no financial, investment, or legal advice. Crypto risks high. Talk to pros first.