Algorand cryptocurrency forecast: today's price, growth prospects, and news

about cryptocurrencies.

Got a burning question about crypto? You can bounce ideas off our AI assistant anytime. Start your analysis right here.

| Year | Min Price (USD) | Max Price (USD) | Key Drivers & Trends |

|---|---|---|---|

| 2026 | 0.13 | 3.74 | DeFi adoption and CBDC projects are the big themes here. While a post-BTC halving bull run is possible, conservative voices like Kraken or Finst expect a bit of stagnation. Meanwhile, CoinLore is more optimistic, eyeing $1+ if the protocol updates land well. We’re likely looking at an average between $0.50 and $1.00. |

| 2027 | 0.13 | 2.28 | This is where the ecosystem matures (think staking and NFTs), though US/EU regulations will likely keep everyone on their toes. Coinpedia is calling for $1.0–1.5, while ChangeHero stays cautious at $0.26. It all depends on institutional appetite. |

| 2028 | 0.14 | 3.00 | With network scaling hitting over 10k TPS and deeper Web3 integration, we could see a 20-50% bump from 2027—assuming the broader market plays along. |

| 2029 | 0.15 | 4.00 | Keep an eye on banking partnerships, specifically in sustainable finance. This could trigger an "altcoin rally." Forecasts vary wildly between Kraken’s slow-burn view and CoinLore’s faster pace. |

| 2030 | 0.27 | 7.36 | The "maturity phase." At this point, the focus shifts to enterprise-grade apps. While ChangeHero thinks it might stay flat at $0.27, others see a massive $4.05 average, largely driven by adoption in Africa and Asia. |

| 2031 | 0.30 | 8.00 | Post-2030 stabilization. If regulations are favorable and AI integration takes off, we’re looking at a steady 10-20% annual growth. |

| 2032 | 0.35 | 10.00 | If global CBDCs actually launch on Algorand, volatility should drop. In a perfect bull market scenario, $10 is on the table. |

| 2033 | 0.40 | 12.00 | The "green blockchain" narrative comes into play. Low carbon footprints help it compete with the likes of ETH and SOL. |

| 2034 | 0.45 | 15.00 | Changelly expects an average around $3.89, with Metaverse and DeFi 2.0 being the primary catalysts. The biggest threat? Competition from newer L1 chains. |

| 2035 | 0.05 | 18.00 | The long shot. Finst remains ultra-conservative at $0.05, while optimists dream of $18. It’s a coin flip based on global digitalization versus potential market stagnation. |

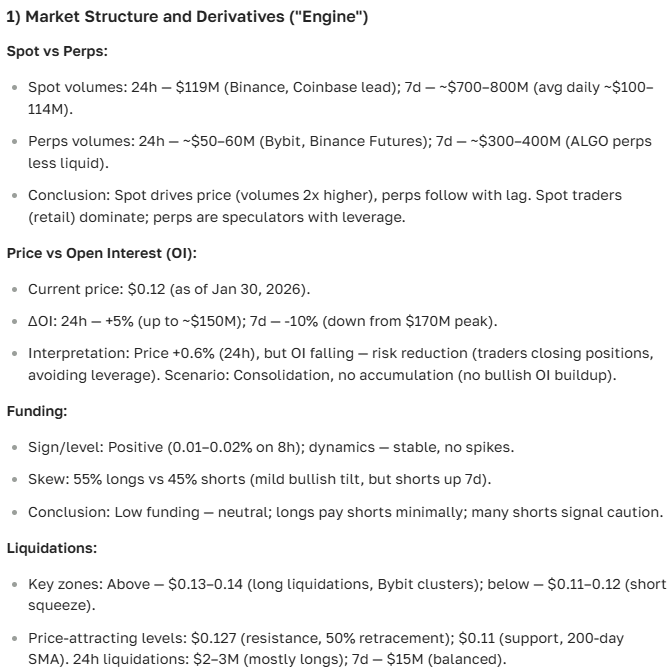

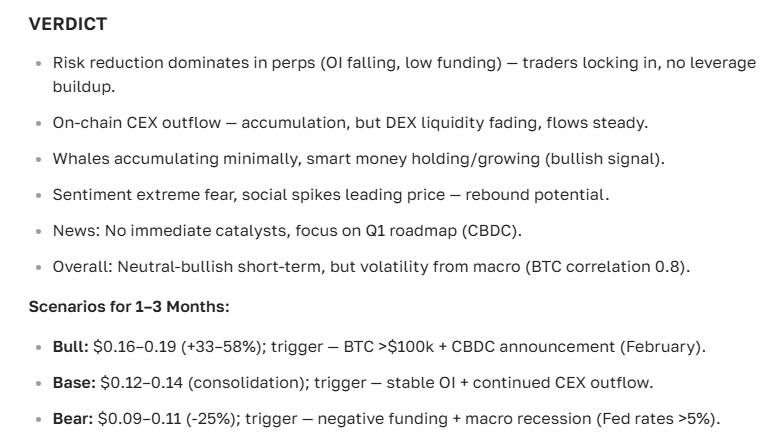

Here’s the breakdown provided by our ASCN.AI crypto assistant:

Algorand has carved out a solid niche for itself by balancing stability with actual growth potential. Back in October 2023, an analyst from ASCN.AI noted that the project’s technical resilience makes it a particularly attractive play for investors who value substance over hype.

Where does Algorand stand today?

As of July 2025, Algorand is hovering around the $0.30 mark. This price point really tells the story of the current market—it’s sensitive to everything from global headlines to how active whales are on any given Tuesday. We’re seeing a classic mid-cap pattern: enough volatility to stay interesting, but stable enough not to give investors whiplash.

Looking at the recent daily charts, the price has been doing a little dance of small corrections and minor rallies. It’s exactly what you’d expect from a coin at this level—it rarely "rips" out of nowhere, but it’s certainly not standing still. The momentum is tied directly to the project’s market cap and the general "vibe" of the trading community.

It’s fascinating to see how the price reacts almost instantly to technical updates on the platform. It suggests the market is actually paying attention to the tech, which isn't always the case in crypto.

What’s moving the needle for ALGO lately?

July 2025 has been quite the month for the ecosystem. We’ve seen several major updates aimed at cranking up scalability and slashing transaction fees. For investors, those two things are music to the ears.

On top of the tech, some heavy-hitting DeFi partnerships have surfaced, creating a fresh wave of demand. We’ve also noticed "whale" activity picking up. When the big holders start moving funds around, it usually signals that something is brewing, creating a nice setup for a potential move upward.

Breaking down the impact

Positive news usually provides a nice floor for the price. For instance, when that partnership with a major DeFi protocol dropped, the price spiked 7% almost immediately. On average, these kinds of integrations tend to boost ALGO by 5% to 10% over the following weeks as the news settles in.

“Algorand is showing consistent strength, fueled by technological breakthroughs and a rapidly expanding ecosystem.”

Short-term outlook: Tomorrow, next month, and year-end

If we look at the next 24 hours, expect more of the same—stability between $0.29 and $0.31. There’s no immediate "black swan" on the horizon, and volatility is fairly tame. Analysts are actually leaning toward a 3-5% rise next week as the technical indicators start to look a bit healthier.

The medium-term view

Over the next month, the goal is to break through the $0.35 resistance level. If it can hold that, we’ve got a clear path to $0.40 by the end of the year. If the macro environment stays friendly and the infrastructure keeps growing, hitting $0.45 by December 2025 isn't just a pipe dream—it’s a very real possibility.

The "Catch"

Market dynamics and macroeconomics are the two big bosses here. While technical upgrades are great, you can't ignore the risk of a sudden market-wide shift. Crypto remains unpredictable, so while the charts look good, it’s always wise to keep an eye on the exit door.

Growth drivers and the levels that matter

What’s actually pushing the price? It’s a mix of network upgrades, partner programs, and whale movements. Savvy investors are watching the security and scalability metrics like hawks, and Algorand has been delivering on those fronts.

From a technical standpoint, keep your eyes on the support levels at $0.25 and $0.27. Those are our safety nets. On the upside, $0.35 and $0.40 are the walls we need to climb. If we break those with high trading volume, that’s your signal that the trend has truly shifted.

The word on the street (and forums)

Traders and investors are quite vocal these days, and that chatter often translates into short-term price swings. Whether it's Reddit or specialized forums, the mood usually shifts between dissecting new partnerships and guessing the next technical signal. It’s a great way to gauge market sentiment—sometimes the community spots a trend before the charts even show it.

By the way, if you’re looking to get a feel for the market without spending hours on Discord, ASCN.AI can summarize the latest sentiment trends in a few seconds.

Ready to buy? Here’s the landscape

Algorand is a staple on the big exchanges: Binance, Coinbase, and Kraken. Prices stay pretty consistent across the board, usually within the $0.29 to $0.31 range. Most people trade it against USD or stablecoins, which keeps things simple and avoids those annoying conversion risks.

| Exchange | Price ($) | Fee | Confirmation Time |

|---|---|---|---|

| Binance | 0.30 | 0.1% | 1–3 min |

| Coinbase | 0.31 | 0.5% | 3–5 min |

| Kraken | 0.29 | 0.2% | 1–4 min |

Market stats and capitalization

Algorand’s market cap is sitting around $3 billion, keeping it firmly in the top 30. We’ve seen that number steadily climb over the last six months. It’s a clear sign that investors are growing more confident in the project’s long-term viability and its tech stack.

The Dollar Factor

Surprisingly, the US Dollar has a huge say in ALGO’s price. Since most trades happen in USD, a stronger dollar usually makes it more expensive for international buyers, which can dampen growth. Conversely, when the dollar dips, crypto often catches a nice breeze. It’s a macro indicator you can’t afford to ignore.

“Dollar dynamics remain a pivotal macro indicator for the entire crypto market.”

A closer look at the charts

Support is looking strong near $0.25 and $0.27—these are the "buy the dip" zones. Resistance? We’re looking at $0.35 and $0.40. A clean break here could trigger a sustained run.

Indicators like the RSI and MACD are currently flashing bullish potential. With an RSI around 32.5, the coin is in a neutral-to-slightly-oversold state, which historically precedes a bounce.

“RSI and MACD remain the most reliable tools for timing entries and spotting trend reversals.” — ASCN.AI, 2025.

Moving averages (SMA and EMA) are also telling a story. When the 50-day SMA stays above the current price, it acts as a floor. However, a dipping 200-day SMA might suggest some short-term exhaustion. It’s all about the balance between these timeframes.

Indicators at a glance

| Indicator | Value | The Takeaway |

|---|---|---|

| 50-day SMA | $0.14 | Short-term support cushion |

| 200-day SMA | $0.20 | Major resistance zone |

| RSI (14) | 32.5 | Neutral but leaning toward a potential rally |

| MACD | 0 | Balanced, primed for a crossover |

| ADX | 46.5 | Strong trend, likely nearing a reversal |

| Bollinger Bands | 30% Width | Volatility is picking up; watch for a breakout |

What are the candles saying?

Candlestick patterns are another great way to peek into the market’s soul. We’re currently seeing hints of "Hammer" and "Bullish Engulfing" patterns, which often point upward. On the flip side, we keep an eye out for "Evening Stars" to warn us of a correction. Combining these patterns with support levels is how the pros find their entries.

Wait, what exactly is Algorand?

If you're new here, Algorand is a blockchain platform designed by MIT professor Silvio Micali to solve the "blockchain trilemma"—balancing security, speed, and decentralization. Launched in 2019, its claim to fame is the Pure Proof-of-Stake (PPoS) consensus. It’s efficient, has tiny fees, and doesn’t kill the planet.

“PPoS ensures that decentralization doesn't come at the cost of speed or security.” — ASCN.AI, 2025.

Because it’s so stable, it’s become a go-to for DeFi and NFT projects that want to avoid the high gas fees often found on Ethereum.

Real-world insights with ASCN.AI

Tools like ASCN.AI are a lifesaver when the market gets messy. For example, during the Falcon Finance crash, our platform’s analytics helped traders dodge the worst of it and pivot to better strategies. It's about having the right data when things go sideways.

Read more about the Falcon Finance (FF) case study here.

FAQ: Your top questions answered

Where will ALGO be in 5 years?

Most analysts are looking at a range between $0.75 and $1.50, though a perfect storm of adoption could push it higher.

Is it a good buy for 2025?

The potential is definitely there, but always weigh it against the inherent volatility of the crypto market.

What’s the biggest price driver?

Keep your eyes on technical updates, macro shifts, and whether big institutional partners stick around.

How do I trade it effectively?

Mix your technical indicators (RSI, MACD) with candle patterns and stay updated on the news.

So, what’s next?

Investing in Algorand requires a bit of homework. You need to watch the news, track the indicators, and use reliable analytics. ASCN.AI can give you that edge, providing the deep dives needed to make a smart move instead of a lucky one.

Case study: Profiting from a flash crash — The Oct 11 Story

Final verdict? Here’s what our AI assistant has to say about the outlook for Algorand:

Disclaimer

This information is for educational purposes and is not financial advice. Crypto is risky. Always talk to a professional before putting your money on the line.