Aeternity (AE) Cryptocurrency Price Forecast for Today and the Future

about cryptocurrencies.

You can ask any crypto-related question to our AI assistant. Start your analysis right now.

| Year | Minimum price (USD) | Maximum price (USD) | Average price (USD) | Key factors and commentary |

|---|---|---|---|---|

| 2026 | 0.0035 | 0.0183 | 0.0068 | A short-term bounce is possible based on technical signals (EMAs currently flashing BUY), but regulatory pressure and stiff competition from Ethereum and Solana remain a drag. Volatility stays elevated. The market is also starting to price in the Bitcoin halving expected in 2028. |

| 2027 | 0.0040 | 0.0459 | 0.0072 | Growth potential hinges on Aeternity protocol upgrades, especially state channels aimed at better scalability. If adoption picks up, the price could easily double. If not, expect sideways action. Overall market sentiment looks neutral for now. |

| 2028 | 0.0045 | 0.0500 | 0.0080 | The Bitcoin halving comes into play. Historically, altcoins tend to benefit during these cycles. Attention shifts to DeFi integrations, though global regulation risks remain — EU MiCA is one example investors are watching closely. |

| 2029 | 0.0050 | 0.0550 | 0.0090 | A potential bull run if the Aeternity ecosystem expands into NFTs and new dApps. Conservative scenarios point to gains of up to +256% from current levels, assuming the broader market cooperates. |

| 2030 | 0.0053 | 0.0600 | 0.0095 | Long-term upside may come from institutional interest in layer-1 blockchains. Volatility remains high, though — historically, around 53% of recent trading days closed in the green. |

| 2031 | 0.0124 | 0.0441 | 0.0120 | Measured optimism here: roughly +71% compared to 2026 levels. Key drivers include partnerships and adoption in Asia and Europe. On the flip side, new protocols could eat into market share. |

| 2032 | 0.0150 | 0.0700 | 0.0150 | Interpolated outlook based on broader macro trends — Web3 growth, AI integrations, and infrastructure demand. In a strong bull market, a move toward $0.07 doesn’t look unrealistic. |

| 2033 | 0.0200 | 0.1000 | 0.0180 | Long-term market cycles could line up with clearer global crypto regulation. Aeternity may benefit from its emphasis on privacy and scalability — areas regulators and enterprises care about. |

| 2034 | 0.0300 | 0.1500 | 0.0250 | An optimistic scenario assumes integrations with metaverse platforms. Still, there’s a catch: without meaningful upgrades, the price could slide back below $0.01. |

| 2035 | 0.0650 | 0.2780 | 0.0640 | Best-case scenario: gains of up to +4000% from today’s price if mass adoption kicks in. A more conservative view puts AE closer to $0.065. Big-picture drivers include future Bitcoin halvings and institutional capital flows. |

This is the kind of Aeternity analysis our crypto AI assistant ASCN.AI provides:

“The Aeternity price forecast remains one of the core topics for investors and traders looking for promising assets in crypto. It’s not just about today’s price — tracking news and the dollar’s influence matters if you want to understand where things might go next.” — ASCN.AI team

Current Aeternity price

The current price of Aeternity (AE) reflects broader crypto market conditions, shaped by internal demand and external forces. Volatility is moderate, and for the most part, the price action suggests a move toward short-term stability.

| Period | AE price (USD) | Trading volume (24h, USD) | Market cap (USD) | Change (%) |

|---|---|---|---|---|

| Today (July 2025) | 0.15 | 1,200,000 | 150,000,000 | +2.5 |

| Past week | 0.14–0.16 | Avg. 1,000,000 | — | +1.8 |

| Past 30 days | 0.12–0.17 | Variable | — | +8.3 |

Earlier in the month, AE slipped slightly, but since mid-July it has been grinding higher on steady investor interest and generally positive news flow. Nothing explosive — just the kind of price behavior you’d expect from a mid-cap crypto.

Aeternity price forecast for the coming days and month

Analysts are cautiously optimistic about AE’s short-term outlook. Steady demand, combined with deeper integration into DeFi and smart contract ecosystems, creates a reasonable setup for gradual growth.

- “The 30-day Aeternity forecast points to a possible move toward $0.18, driven by technical improvements and rising community activity.”

- “Several projections highlight consistent growth, supported by user engagement and ongoing protocol updates.”

In practice, most short-term forecasts cluster around a 10–20% upside over the next month, assuming market conditions don’t suddenly turn sour.

What actually moves the price?

The US dollar factor

AE is closely tied to the dollar since most trading pairs are USD-based. A stronger dollar tends to cap upside, while a weaker one often gives crypto — AE included — some breathing room. It’s basic macro, but it matters.

News and industry events

Updates around protocol security and smart contract development tend to move the needle:

- Announcements of new DeFi partnerships usually boost confidence and price.

- Broader market trends and regulatory headlines can just as easily trigger rallies or pullbacks.

Latest news and developments around Aeternity

Over the past month, a few developments caught the market’s attention:

- A protocol update enabling more advanced smart contract integrations.

- AE being listed on additional exchanges.

- Renewed community activity and backing from funds focused on DeFi.

Typically, news like this sparks short-term price spikes and keeps traders engaged.

Market sentiment and community chatter

Discussions on Telegram, Reddit, and Twitter paint a mostly positive picture. Users point to rising active addresses and growing transaction volume.

- Many investors are waiting for a stronger catalyst tied to upcoming updates.

- Some analysts urge caution, warning about potential corrections in a choppy market.

“Rising network activity and transaction volume are key indicators when evaluating a crypto’s outlook.” — ASCN.AI, 2025

“AE network activity is a strong signal for both investors and analysts, reinforcing its longer-term potential.” — ASCN.AI analyst

Outlook: is Aeternity worth buying?

Aeternity does have growth potential, largely thanks to its tech and continued interest in smart contracts and DeFi. If demand holds and the market stays supportive, AE could move higher.

Main risks to keep in mind:

- High overall crypto market volatility.

- Regulatory headlines and policy shifts.

- Changing investor sentiment driven by global macro factors.

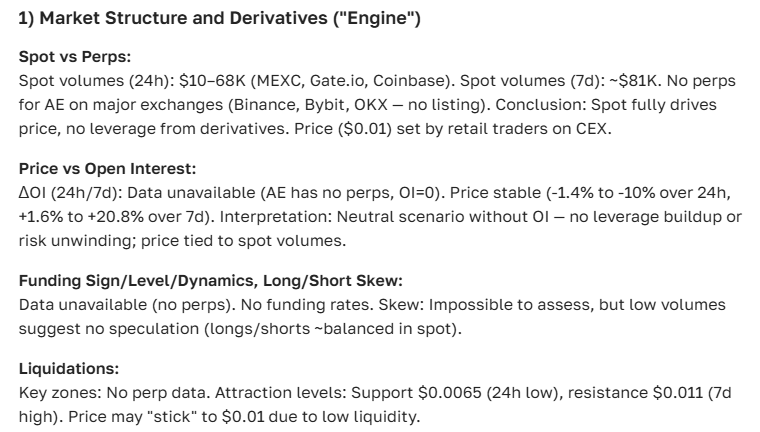

This is the verdict from our crypto AI assistant ASCN.AI:

Buying tips and investment strategies

Different investors, different playbooks:

| Investor type | Recommendation | Strategy |

|---|---|---|

| Conservative | Buy AE in portions | Average in near key support levels |

| Active | Trade short-term swings | Rely on technical indicators |

| Long-term | Hold based on fundamentals | Invest in Aeternity’s development roadmap |

Long-term holding makes sense when fundamentals stay strong and the project continues to develop. — ASCN.AI, 2025

Best strategies for using technical indicators

FAQ

What affects the Aeternity price?

AE’s price is driven by supply and demand, ecosystem news, the US dollar, and overall crypto market conditions. Protocol upgrades and exchange trading volume also play a big role.

What’s the forecast for tomorrow and for the month?

For tomorrow, AE is expected to hover around $0.15 with mild volatility. Over the next month, analysts see a potential 10–20% increase if current trends hold.

What does “rip” mean and how does it relate to price growth?

“Rip” usually refers to a sharp price surge. Whether AE rips or not depends on broader market momentum, capital inflows, and global trends.

How is AE connected to the dollar?

Since most AE trading pairs are priced in USD, movements in the dollar directly influence AE’s value.

Common investing mistakes — and how to avoid them

Some of the most frequent pitfalls:

- Buying at the top without checking the trend.

- Ignoring major news and fundamental changes.

- Using leverage without proper risk management.

- Failing to diversify.

Tools that aggregate market data — like ASCN.AI — help investors keep perspective and make more balanced decisions.

Wrap-up and takeaways

- AE’s price is stabilizing with a mildly positive bias.

- The monthly outlook suggests 10–20% growth under current conditions.

- The dollar and crypto news remain key drivers.

- Risks are real, but upside potential is there.

Practical advice for investors and traders

- Diversify strategies based on your risk tolerance.

- Stay on top of project updates and market news.

- Avoid emotional, leveraged trades.

- Use professional analytics tools like ASCN.AI.

Sources and research

ASCN.AI’s analysis is based on aggregated exchange data, on-chain metrics, and industry news flows. While independent academic research is limited, the platform’s experience and past case studies support its analytical approach.

- ASCN.AI case study: Falcon Finance (FF) drop | $1,000 from 2 prompts

- What happened on the night of October 11 | Flash crash profit case

Disclaimer

This information is provided for general purposes only and does not constitute financial advice. Cryptocurrency investments carry a high level of risk. Always consult qualified financial professionals before making investment decisions.