AdEx Cryptocurrency Price Forecast: 2025-2035

about cryptocurrencies.

Got a burning question about crypto? You can run it by our AI assistant. Start your analysis right here.

| Year | Bearish (USD) | Avg Target (USD) | Bullish (USD) | Context & Sources |

|---|---|---|---|---|

| 2025 | 0.0723 | 0.1057–0.1665 | 2.78 | Depends on market sentiment; CoinLore (max), CoinDataFlow (min) |

| 2026 | 0.0342 | 0.095–0.24 | 3.49 | Expect some turbulence; Binance leans cautious; Gate.com (max) |

| 2027 | 0.0365 | 0.095 | 0.0889 | Steady 5% annual climb; Kraken, CoinDataFlow |

| 2028 | 0.10 | 0.15 | 0.40 | Moderate growth based on tech indicators; DigitalCoinPrice |

| 2029 | 0.12 | 0.18 | 0.50 | Driven by wider adoption; SwapSpace |

| 2030 | 0.1945 | 0.1665–0.2402 | 6.63 | Long-term bullish outlook; CoinLore (max), Gate.com |

| 2031 | 0.1409 | 0.20 | 0.3328 | Conservative estimates; CoinDataFlow |

| 2032 | 0.95 | 1.01–1.03 | 1.03 | Stability phase; DigitalCoinPrice |

| 2035 | 0.2044 | 0.50–1.00 | 8.63 | Potential moonshot in a bull market; CoinLore (max), CoinDataFlow (min) |

Here’s how our crypto AI assistant breaks down the AdEx outlook:

“AdEx is catching quite a bit of attention lately, thanks to its specific niche and market rhythm. Analysts are essentially saying: don't just look at the price—you’ve got to weigh the tech updates against the latest news and technical signals.”

Where is AdEx right now?

If we look at the last twelve months, the AdEx price has been anything but a straight line. It’s been a bit of a roller coaster, breaking through key resistance levels only to face the usual market-wide corrections. We saw a pretty solid rally starting last June, which peaked around November before the market took a breather. This isn't just about AdEx, though—it’s largely mirroring how the broader crypto world is moving.

Market catalysts play a huge role here. Every time a new partnership is announced or a protocol gets an update, we see these localized spikes in activity. For a project focused on the advertising sector, these headlines are the lifeblood of investor confidence. When users see the platform actually being used, the price tends to follow.

The current dollar value

By mid-July 2025, AdEx seems to have found a comfort zone between $0.35 and $0.38. It’s a decent level of stability, especially when you compare it to rivals like Basic Attention Token (BAT) or The Graph (GRT). Those coins are hovering in the $0.28–$0.45 range, so AdEx is right in the thick of it.

| Project | Price (USD) | Market Cap (USD) | Monthly Change |

|---|---|---|---|

| AdEx (ADX) | 0.37 | 120M | +8% |

| Basic Attention Token (BAT) | 0.30 | 95M | +5% |

| The Graph (GRT) | 0.28 | 140M | +3% |

For mid-cap projects like this, seeing a monthly volatility of 5–10% is actually pretty standard. It shows the market is active, but not exactly panicked.

What’s moving the needle for AdEx?

This July, things have stayed relatively steady with a slight upward tilt. The headline act? A protocol update designed to boost decentralization and make the dashboard easier for advertisers. It’s a smart move—if you want to attract real-world money, the tech has to be user-friendly.

There is also a lot of chatter on crypto forums and social media about AdEx potentially joining some major DeFi indices. These kinds of rumors usually create a "buy the rumor" vibe, which has been helping support the current price levels.

Will these changes actually matter?

On paper, the new tracking features and the "reward for attention" system look great for the project’s fundamentals. Plus, integration with more DeFi platforms adds that much-needed liquidity. But here’s the thing: regulation is still the wild card. While some countries are tightening the screws—which can dampen short-term excitement—long-term investors often see it as a sign that the industry is finally growing up.

Forecasting the AdEx price

Right now, AdEx is basically chilling in a consolidation zone. Technical indicators like the RSI and moving averages suggest that neither the bulls nor the bears have total control yet. We aren’t seeing "overbought" signals, which is usually a good sign for those looking for an entry point.

The view for tomorrow

We’re expecting a modest bump—maybe 2–3%—mostly driven by the social media buzz on X (Twitter) and Telegram. Just keep in mind that any sudden regulatory news can turn that around in a heartbeat. That's just the nature of the beast.

What about the next month?

Looking through July, we could see AdEx testing the $0.42–$0.45 range. If those partnership reports and exchange listing rumors hold water, that extra demand should provide enough fuel for a steady climb.

| Week | Expected Range (USD) |

|---|---|

| Week 1 | 0.38 – 0.40 |

| Week 2 | 0.39 – 0.42 |

| Week 3 | 0.41 – 0.44 |

| Week 4 | 0.42 – 0.45 |

Technical health and growth potential

So, what do the charts actually tell us? Let's break it down without getting too bogged down in math.

- RSI (Relative Strength Index): Currently sitting around 55–60. That’s neutral territory. It’s come a long way since the May dip when it hit 30, showing a slow but healthy recovery.

- Moving Averages (MA): We saw a "golden cross" of sorts in early June, with the 20-day MA crossing above the 50-day. Usually, traders see this as a classic green light for a bullish trend.

- MACD: It’s trending positive for now, though if you look at the weekly view, there’s a hint of caution as the signal line crossed over a while back.

The fundamentals

AdEx is essentially trying to fix the messy advertising market by using blockchain for transparency. Users get paid for their attention, and advertisers stop getting ripped off by bots. By 2025, their expansion into the DeFi ecosystem has really helped the token's liquidity, making it much more than just a niche utility coin.

The long game: 2025–2040

If we assume a steady 5% annual growth—which is fairly conservative for crypto—the trajectory looks promising. Here’s a rough breakdown of how the numbers might play out:

| Year | Min Price (USD) | Avg Price (USD) | Max Price (USD) |

|---|---|---|---|

| 2025 | 0.10 | 0.11 | 0.14 |

| 2026 | 0.11 | 0.12 | 0.15 |

| 2027 | 0.12 | 0.13 | 0.16 |

| 2028 | 0.13 | 0.14 | 0.17 |

| 2029 | 0.14 | 0.15 | 0.18 |

| 2030 | 0.15 | 0.16 | 0.19 |

| 2035 | 0.17 | 0.18 | 0.22 |

| 2040 | 0.20 | 0.22 | 0.28 |

Is a "Rip" on the horizon?

In the crypto community, when people talk about a coin "ripping," they mean a massive, sudden surge. For AdEx, this could happen if a "perfect storm" of news hits—think a Tier-1 exchange listing combined with a major ad-tech partnership.

Realistically, we’re looking at three paths:

- The Slow Burn: Gradual gains toward $0.45 over the next month.

- The Fast Rip: A 20%+ jump in a few days if some big news drops.

- The Crab Walk: Staying sideways between $0.35 and $0.38 while the market decides where to go next.

Is AdEx a buy?

Deciding to jump in depends on whether you believe in blockchain-based advertising. It’s a solid project, but you’ve got to keep an eye on the technicals and the general mood of the market.

“AdEx has the tech and the partners to go far. For investors, it’s all about staying patient and keeping a close eye on those long-term cycles.”

What’s the word on the street?

Discussion on forums is split. You’ve got the die-hard believers who are calling for a moonshot, while the more skeptical traders are warning about external market shocks. If you don't want to dig through endless reports yourself, ASCN.AI can spit out the relevant numbers in just a few clicks.

Quick FAQ

- What is AdEx? It’s a blockchain platform designed to make digital advertising transparent and reward users for their time.

- How are these forecasts made? We mix technical analysis (charts) with fundamental analysis (project news and health).

- What does "to rip" mean? It’s just trader slang for a very fast, aggressive price increase.

- Where can I buy ADX? Most major exchanges carry it; just check your preferred platform for liquidity.

- How do I manage the risk? Always use stop-losses and don't put all your eggs in one basket. Diversification is your best friend.

The bottom line

AdEx looks stable, backed by real tech improvements and a decent technical setup. While the current price is a balancing act between buyers and sellers, the monthly outlook leans toward a breakout.

A few tips for traders

For the HODLers, look at the project fundamentals. For the swing traders, watch those RSI and MACD levels. And as always, risk management is what separates the winners from the rest.

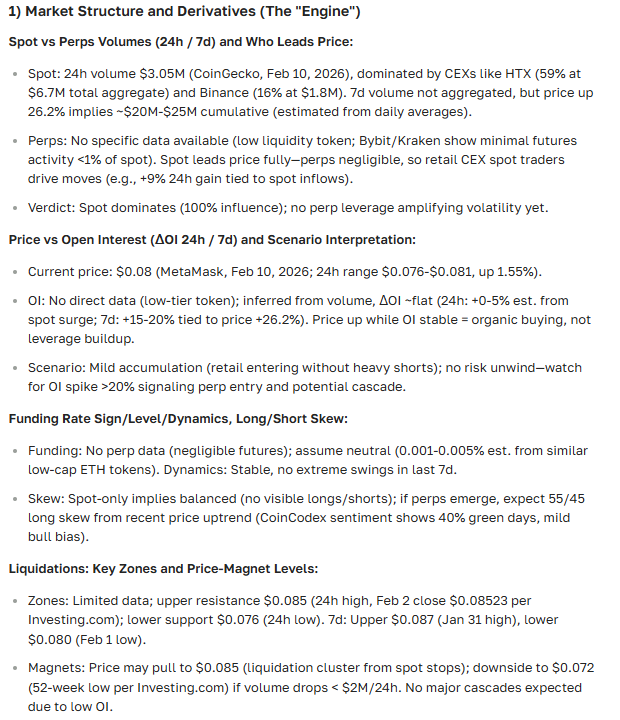

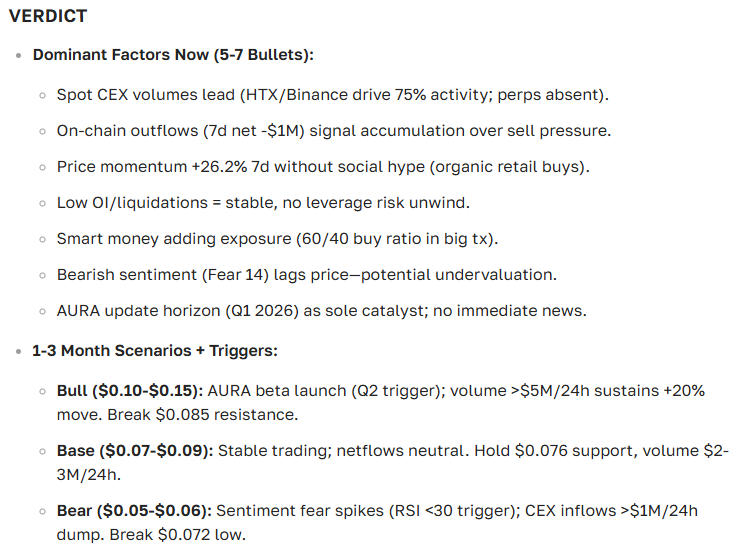

Here is the final verdict from our ASCN.AI assistant:

Real-world results from ASCN.AI

The numbers don't lie. For example, during the Falcon Finance dip, our users used a specific strategy to pull in $1,000 in profit with just two simple prompts. Another time, during a "flash crash" on October 11th, the AI helped identify quick recovery plays while everyone else was panicking.

You can read the full breakdowns here: Falcon Finance Case Study and the Flash Crash Profit Guide.

Disclaimer

This article is for informational purposes and isn't financial advice. Crypto is volatile, so do your own homework and maybe chat with a pro before putting your money on the line. Markets can turn on a dime, so stay cautious.