1inch cryptocurrency forecast for 2025-2035: latest news and analytics

about cryptocurrencies.

Got questions about crypto? Our AI assistant at ASCN.AI is always ready to dive into the data for you. Start your analysis right here.

| Year | Min Price (USD) | Max Price (USD) | Average Price (USD) | What’s driving it? |

|---|---|---|---|---|

| 2026 | 0.18 | 0.65 | 0.40 | Clawing back from a 2025 dip ($0.38 down to $0.15). We're looking at higher DEX volumes and 1INCH protocol tweaks. Watch for an ETH ETF boost, though US/EU regulations are the elephant in the room. |

| 2027 | 0.35 | 0.80 | 0.58 | DeFi adoption picks up speed. It tracks ETH closely (expecting a 20-30% jump). Major L2 partnerships with the likes of Base and Arbitrum will be key here. |

| 2028 | 0.50 | 1.10 | 0.75 | Branching out to Solana and BNB chains. If TVL clears $1B, things get interesting. Plus, the 2028 BTC halving usually gives altcoins a second wind. |

| 2029 | 0.70 | 1.50 | 1.05 | AI meets DEX aggregation and cross-chain swaps become the norm. In a bull market, we could see a 40% year-over-year climb. Competition from Uniswap v4 remains a threat. |

| 2030 | 1.00 | 2.20 | 1.50 | DeFi hits maturity, and 1INCH becomes the industry standard for aggregators. We’re eyeing a $1B+ market cap as global crypto regulations finally clear up. |

| 2031 | 1.30 | 2.80 | 1.90 | A steady long-term climb of roughly 25-30% annually. The focus shifts to staking and governance. We might also see a NFT/DeFi 2.0 resurgence. |

| 2032 | 1.60 | 3.50 | 2.40 | Protocol scaling at its peak, deep integration with major Web3 wallets. Growth starts correlating with global GDP in emerging markets. |

| 2033 | 2.00 | 4.20 | 3.00 | The market stabilizes, and 1INCH likely sits in the top 50 by cap. Keep an eye on token burn mechanics. The main risk? High-profile DeFi exploits. |

| 2034 | 2.50 | 5.30 | 3.80 | Diversification into Real-World Assets (RWA). Institutional money finally starts moving the needle for the aggregator. |

| 2035 | 3.00 | 6.50 | 4.70 | The endgame: 1INCH as a cornerstone of a $10T+ DeFi ecosystem. Tech-wise, zero-knowledge proofs take center stage. Optimistically, that's a 30x jump from today's levels. |

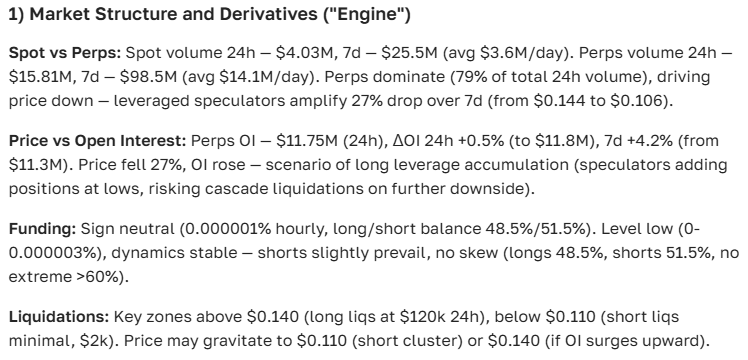

Here is how the ASCN.AI crypto assistant breaks down the 1inch outlook:

“The crypto market is a moving target, and 1inch shows the kind of unique volatility that needs a multi-layered approach to analyze properly.” — ASCN.AI Expert

Predicting where 1inch is headed requires more than just looking at a chart. You’ve got to dig into the factors pushing it up (or dragging it down) and, honestly, ask if the project still has legs. We’ve pulled together the latest analytics to see what’s in store for 1inch today, tomorrow, and a month from now. Below, you’ll find technical breakdowns, analyst takes, and a bit of practical advice to help you decide if this coin belongs in your portfolio.

Where does 1inch stand right now?

Through July and August, 1inch has been testing some pretty significant support and resistance levels. It’s been bouncing between its highs and lows—nothing unusual for a liquid, volatile asset, but it’s exactly what traders look for when trying to spot the next move. These fluctuations are the bread and butter of our short-term forecast.

For the most part, 1inch is holding steady within its primary price corridors. It’s sensitive to news, sure, but it seems to be following the broader market rhythm for now.

What’s actually moving the needle?

- Overall market sentiment and where 1inch sits in terms of total market cap.

- Under-the-hood protocol updates and whispers of new partnerships.

- Smart contract activity and tokenomics—essentially, how many people are actually using the token.

- The macro picture: If the US dollar fluctuates, crypto usually feels it.

- The "Smart Money" effect: What the big whales are doing behind the scenes often dictates the trend before the rest of the market catches on.

Whale activity is a huge deal here. Large-volume trades can shift liquidity and set a new direction for the price in hours.

Source: ASCN.AI, What Smart Money is holding

The roadmap: What’s next for 1inch?

If we look at the latest data and technical indicators, there’s a decent chance 1inch could see a moderate rally over the next couple of days. Indicators like the RSI (Relative Strength Index) and various moving averages are hovering in "neutral" territory. It’s a bit of a waiting game—one piece of good news could easily spark a bullish run.

Indicators like RSI and MA are great for cutting through the noise. They tell us if a coin is being oversold or if everyone’s already piled in, which is vital for anyone trading on shorter timeframes.

Source: ASCN.AI, Mastering Technical Indicators in Crypto

The 30-day outlook: Slow and steady?

Over the next month, we’re anticipating a gradual climb. Expect some short-term pullbacks—that’s just crypto—driven by external headlines or macro shifts. If demand stays consistent, we could see a 10% to 20% gain by month’s end. It’s a cautious projection, but the fundamentals look solid.

Volatility is always the wild card, but the current trend suggests a slow upward trajectory rather than a crash.

Source: ASCN.AI, Full Crypto Market Analysis

What about a "rip"?

In trader-speak, a "rip" is that sudden, aggressive price spike. For 1inch, this usually happens when they drop a major protocol update or announce a high-profile partnership. When it rips, the price can jump double digits in a few hours, dragging in new investors and pumping the market cap. But here's the catch: these moves are high-risk. High volatility is a double-edged sword.

“A 1inch rip could be triggered by a single protocol upgrade, potentially sending the price up by 30% or more in a heartbeat.” — ASCN.AI Analyst

Source: ASCN.AI, Top 10 AI Crypto Trading Bots for 2025

Recent headlines you should know about

- New protocol versions aimed at making liquidity even deeper.

- Fresh partnerships with leading DeFi platforms (liquidity is everything).

- The ever-changing regulatory landscape in the US and Europe.

- Social media buzz—sometimes a trending thread on X (Twitter) is all it takes to shift sentiment.

By the way, when 1inch teams up with other DeFi projects, it’s usually a direct win for the token’s liquidity and demand.

Source: ASCN.AI, How Partnerships Drive Price: The Aptos Case

Latest Crypto News & Analytics

Is it time to buy? Let’s talk strategy.

1inch is a high-volatility play. There’s no sugarcoating it. If you’re thinking about jumping in, you need a plan to manage that risk:

- Don't go all-in; treat it as one part of a diversified portfolio.

- Keep a very close eye on the news cycle—it moves faster than the charts.

- Avoid "FOMO" (Fear Of Missing Out). If it already ripped 20%, wait for the cool-down.

- Use tools to do the heavy lifting. If you don't want to dig through reports, ASCN.AI can spit out the numbers in a few clicks.

Source: ASCN.AI, Crypto Portfolio Optimization Strategies

What kind of returns are we looking at?

It really depends on your timeframe. Medium-term, a 10-20% gain is a reasonable target. Short-term? You might catch a "rip" or get caught in a correction. Interestingly, some traders using ASCN data recently managed to snag 15% in a single week by timing a recovery perfectly.

Case Study: How to Profit from a Flash Crash

FAQ: Quick Hits

What does "to rip" actually mean?

It’s just slang for a sharp, sudden price increase. It usually happens when a project releases big news that catches the market off guard.

How much does the price move in a month?

1inch behaves like most large-cap DeFi tokens. It’s got high liquidity, so while it fluctuates daily, it tends to follow broader cycles of growth and correction.

What drives the forecast?

It’s a mix of everything: news, partnerships, technical data (like RSI), and macro-economics. If you're feeling overwhelmed, a quick prompt in ASCN.AI usually clears the fog.

Where can I get the latest updates?

The official 1inch channels are good, but for the "why" behind the moves, stick to analytical platforms like ASCN.AI and active crypto forums.

What is 1inch, exactly?

Think of 1inch as the Google Flights of crypto. It’s a decentralized aggregator that scours various DEXs to find you the best possible price for a swap. Instead of you manually checking five different platforms, 1inch does it instantly. Their token isn't just for show either—it’s used for governance and revenue sharing. Their routing tech is genuinely impressive, helping traders avoid "slippage" (when the price changes mid-trade) and keeping fees as low as possible.

Source: ASCN.AI, Blockchain 101: From Transactions to Analysis

The long game

Looking further out, the future for 1inch looks pretty bright. As DeFi becomes more mainstream, the need for aggregators only grows. If the team keeps shipping updates and the market doesn't face a total meltdown, we expect the token value to trend upward significantly over the next few years.

Source: ASCN.AI, How AI is Changing the Crypto Trading Game

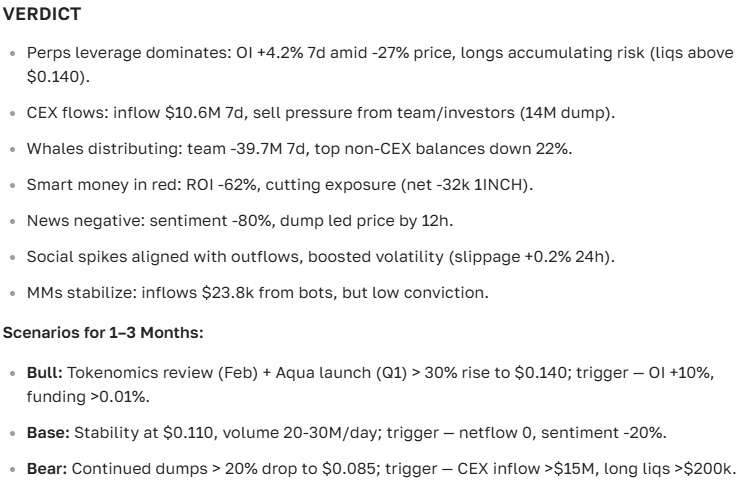

The Verdict

1inch has plenty of upside. Between its technical foundation and its role in the ecosystem, the potential is there. Short-term forecasts look positive, but keep an eye out for those sudden "rips." As always, don't trade with emotion—use the data, keep your head cool, and manage your positions wisely.

And here is the final word from the ASCN.AI assistant:

Case Studies & Further Reading

- The Falcon Finance (FF) Case: $1000 with 2 Prompts

- What happened on Oct 11? Making money on a flash crash

Disclaimer

This isn't financial advice. Crypto is a wild ride and you can lose your shirt if you aren't careful. Always do your own research or talk to a professional before putting your money on the line.