Hyperliquid Price Prediction 2025-2030: Insights for Investors

about cryptocurrencies.

Overview of Hyperliquid

What is Hyperliquid?

Hyperliquid is a decentralized exchange that specializes in perpetual futures trading and runs on its own Layer 1 blockchain. Users trade perpetual contracts with up to 50x leverage, enjoying low fees and fast execution via an order book system. Unlike centralized exchanges, it settles all trades on-chain to cut counterparty risk and improve transparency. Traders can access major cryptocurrencies and altcoins, along with built-in cross-margin trading.

The protocol launched in 2022 and built momentum in DeFi by solving liquidity issues in perpetuals. The HYPE token handles governance and utilities like fee discounts and staking rewards. Investors studying hyperliquid price prediction should note how this setup links growth to wider DeFi use.

Current Market Status

As of early 2025, Hyperliquid manages over $500 million in total value locked, with daily trading volume topping $1 billion on busy days. The HYPE token trades near $20, giving it a market cap of about $200 million. New connections to leading wallets and oracles have improved liquidity, ranking Hyperliquid among the leading DEXs for derivatives.

Traders feel optimistic about rising demand for on-chain trading, especially as regulators eye centralized platforms more closely. On-chain data shows active addresses up 40% from last year, pointing to solid user activity. These trends shape hyperliquid crypto price prediction.

Price Prediction Strategy

Methodology of Prediction

Predictions draw from technical analysis, on-chain data, and macroeconomic signals. Technical tools like moving averages, RSI, and Bollinger Bands spot trends, while on-chain reviews monitor transaction volume, holder spread, and liquidity from platforms such as Dune Analytics. Broader influences cover Bitcoin halving events and worldwide adoption trends.

ASCN.AI improves on this by pulling live Web3 data from our dedicated nodes tied to Ethereum and Solana-like networks, including sentiment from Telegram and Twitter.

Users can ask ASCN.AI things like "Analyze Hyperliquid's on-chain metrics for price trends" and get organized forecasts in seconds.

Historical Data Analysis

From the start, the HYPE token jumped 300% in 2023 after the mainnet went live, hitting $35 before dropping to $10 during the market slump. It rebounded in 2024 with DeFi's comeback, as perpetuals trading reached $100 billion overall. Events like the Chainlink oracle partnership led to 50% price rises.

The token's volatility runs at 80% annualized, common for DEX assets. Against competitors like dYdX, Hyperliquid's order book cuts slippage by 20%, which helps drive steady expansion. This history shapes hyperliquid coin price prediction models.

Hyperliquid Price Prediction 2025

Economic Factors

In 2025, economic rebound after inflation may bring more money into crypto, as institutions boost DeFi TVL to $200 billion. Clearer rules in the EU and US benefit decentralized setups, which could grow Hyperliquid's users by 150%. With Bitcoin expected between $80,000 and $120,000, altcoins will rally harder, lifting perpetuals DEXs like this one.

Competition from Solana rivals and fee battles pose hurdles.

ASCN.AI users can tackle them with prompts like "Forecast Hyperliquid impact from 2025 regulations," which produce reports on compliance issues and chances drawn from live policy updates.

Market Forecasts

Analysts expect HYPE to hit $50 by mid-2025, up 150% from now, thanks to more asset options and staking returns over 15%. In strong cases, DeFi volume doubles to push it higher; in weak ones, it stops at $30 during pullbacks. For hyperliquid price prediction 2025, the middle view lands at $40, backed by breaks past the $25 resistance level.

Example ASCN.AI response to "Give Hyperliquid price prediction 2025 with scenarios": "Base case: $45 (DeFi growth); Bull: $60 (adoption surge); Bear: $25 (recession). Watch TVL exceeding $1B for confirmation."

Hyperliquid Coin Price Prediction 2030

Long-term Growth Potential

By 2030, Hyperliquid might claim 10% of the $10 trillion derivatives market with Layer 1 upgrades for faster-than-one-second settlements. The token's uses grow to include voting on governance and sharing revenue, offering up to 20% APY for stakers. Ties to wider Web3 features like NFTs and real-world assets prepare HYPE for everyday use.

Blockchain links and zero-knowledge proofs for privacy will support lasting expansion. Long-range models predict rapid uptake as everyday traders move from centralized exchanges, sending HYPE above $200.

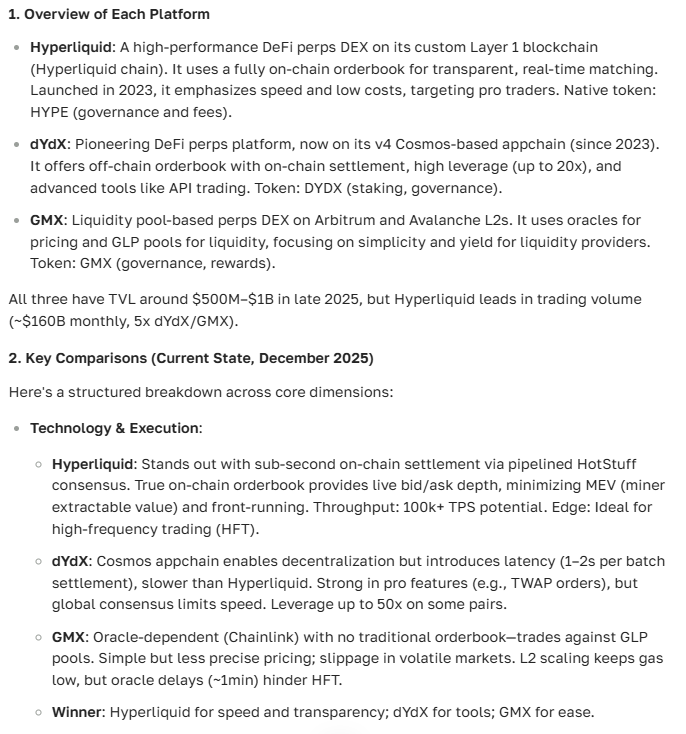

Comparative Analysis with Similar Cryptocurrencies

Against dYdX (DYDX at $2, market cap $400M), Hyperliquid delivers better liquidity at twice the volume, though it trails in multi-chain features. Next to GMX (GMX at $25), the order book limits manipulation, which could help it do better under regulations. Both gained 200% in 2024, yet Hyperliquid's own chain adds a strong defense.

For hyperliquid price prediction 2030, estimates run 50% ahead of rivals thanks to the perpetuals emphasis, if DeFi keeps developing.

ASCN.AI prompt: "Compare Hyperliquid to dYdX and GMX for 2030 outlook" provides tables on metrics such as TVL expansion and token speed.

Investment Insights and Strategy

Short-term vs Long-term Investments

Short-term plays fit traders who use volatility for 20-50% moves through perpetuals, buying dips under $18 and setting stops at $15. Long-term investors build positions in flat periods, aiming for 5x gains by 2030 via staking and governance. Add 10-20% HYPE to portfolios mixed with BTC and ETH.

ASCN.AI helps with choices: The prompt "Short-term trade setup for Hyperliquid" gives entry and exit points from current charts and sentiment, letting users move 10x quicker than doing it by hand.

Risk Assessment

Main risks cover smart contract flaws (checked by audits) and market drops that wipe out leveraged trades. Rule changes might add KYC requirements, hurting DEX draw. Spread investments to handle the 70% drops from past cycles.

ASCN.AI checks risks: "Assess Hyperliquid rug pull indicators" spots issues like thin holder bases or odd transfers.

Hyperliquid offers big upside amid crypto's natural ups and downs. Investors should track on-chain data for good entry spots.

How Can ASCN.AI Help You Understand Hyperliquid?

ASCN.AI provides targeted insights on Hyperliquid using direct Web3 data access, such as on-chain metrics and sentiment from our nodes. This gives precise, up-to-the-minute analysis that other AI tools can't match without blockchain ties, leading to smarter moves in choppy markets.

Ask ASCN.AI: "Give me the latest price prediction for Hyperliquid for 2025 and 2030."

Responses cover scenario details, similar assets, and practical steps, smoothing the path from research to plans.

For instance, users input "Detailed report on Hyperliquid tokenomics and 2026 trading volume forecast," receiving a 10-second summary with risks, growth factors, and portfolio advice. This accuracy lets traders find chances, such as perpetuals arbitrage, without wasting time on disjointed searches.

Subscribe to ASCN.AI for $29/month to get unlimited queries, blending data from DEXs, news, and social feeds. Clients say it speeds up insights for better trades — change your method now.