How to buy cryptocurrency: from fiat to DEX - ASCN

about cryptocurrencies.

The first step into crypto is always the hardest. Where do you even start when all you’ve got is fiat? Terms like “exchange,” “DEX,” and “wallet” are everywhere, but for beginners, the buying process itself often feels like a real quest.

In this piece, we’ll walk through the journey from plain old fiat to decentralized exchanges — step by step, without fluff, and with practical tips that actually work.

Step 1: Preparation (What You’ll Need)

Before you buy your first crypto, it’s worth getting your “tools” ready and learning a few ground rules. The very first thing is setting up a wallet — and protecting it properly. That one move decides how safe your future assets will be.

Choosing a Wallet (MetaMask, Trust Wallet)

Pick your wallet carefully: MetaMask, Trust Wallet, Coinbase Wallet — take your pick. These aren’t just vaults; they’re gateways to managing tokens, smart contracts, and connecting to DEX platforms.

Creating and Setting It Up

Here’s how it usually goes:

-

Download the app or browser extension.

-

Create a new wallet or import an existing one.

-

Write down your seed phrase somewhere safe — on paper, offline.

-

Set a strong password, add biometrics or a PIN if available.

The Golden Rule: Protect Your Seed Phrase

Never, ever share your seed phrase. Don’t type it on websites, don’t store it in screenshots or the cloud. If someone gets access to it, your assets are gone — permanently.

Step 2: Buying Crypto on a CEX (Centralized Exchange)

Once your wallet’s ready, you can finally buy your first crypto with fiat. Centralized exchanges are the simplest and safest place to start.

Picking an Exchange (Binance, Bybit, KuCoin)

Now we’re talking CEX — centralized platforms. They’re straightforward and beginner-friendly. The interface looks like online banking, and you can buy Bitcoin or Ethereum with your card in a few clicks. No blockchain deep dive required.

Registration and KYC

Signing up takes a few minutes:

-

Enter your email and set a strong password.

-

Verify your identity with an ID (passport, driver’s license) and a quick selfie.

-

Enable 2FA right away — it adds a vital layer of security.

Buying BTC or ETH with Fiat

Pick a pair like EUR/BTC or USD/ETH, enter the amount, confirm payment (card or bank transfer). Once done, the asset appears in your exchange account.

Pros and Cons of Keeping Funds on the Exchange

Pros:

-

Convenient — you don’t need to mess with wallets right away.

-

Easy access to trading and swaps.

Cons:

-

You don’t own your private keys — “not your keys, not your crypto.”

-

Possible risks: hacks, frozen accounts, or legal issues.

Step 3: Moving Funds to Your Own Wallet

After buying, it’s smart to move your crypto under your own control. That’s how you stay safe and avoid the classic “exchange risk.”

Finding Your Wallet Address

Open your wallet app → tap “Receive” → select the right network (Ethereum, BNB, Polygon, etc.) → copy the address (starts with 0x… or another prefix).

Withdrawing from the Exchange

In your CEX account, go to Withdraw, paste your wallet address, enter the amount, and confirm via 2FA and email. The exchange will push the transaction to the blockchain.

Checking the Transaction

Copy the transaction hash and paste it into a blockchain explorer like Etherscan or BscScan. You’ll see its status: pending, success, or failed.

The Problem: The Wild West of DEX Tokens

On decentralized exchanges, you’ll find thousands of tokens — but not all of them are trustworthy. For beginners, that’s where the real risks start.

Scam Tokens and Rug Pulls

Hundreds of new tokens pop up on DEX every day. Many are traps — coded with hidden restrictions or designed for rug pulls, where developers drain the liquidity and vanish.

The Challenge of Analyzing New Projects

You have to dig into smart contracts, liquidity pools, funding sources, and token pairs — and that’s not easy. Luckily, there are specialized AI tools that handle this detective work for you.

How to Avoid Buying Trash

Stick to these simple rules:

-

Check the contract for an audit.

-

Avoid low-liquidity tokens.

-

Look at transfer history.

-

Use analysis tools before you buy.

How ASCN.AI’s AI Helps You Make Smarter Choices

Manually checking every token is exhausting — especially when you’re new. That’s where ASCN.AI comes in. Its AI agent simplifies the research and filters out the shady projects.

Quick Token Audit

Just paste the token’s contract address — and within seconds, you get a full report. The AI scans the code for red flags like hidden functions, vulnerabilities, or scam-like patterns. No more reading cryptic code — ASCN.AI handles that part for you.

Contract and Liquidity Analysis

The system checks things most people miss: restrictions on selling, stealth fees, or token locks. It also evaluates liquidity — because a token you can’t sell isn’t worth much, no matter how shiny it looks.

The Power of Real Web3 Data

Unlike typical scanners, ASCN uses actual on-chain data. That means it doesn’t just read code — it sees the live activity behind it: who’s moving funds, how tokens are distributed, and what major wallets are doing. In short, it’s a real-time X-ray of the market.

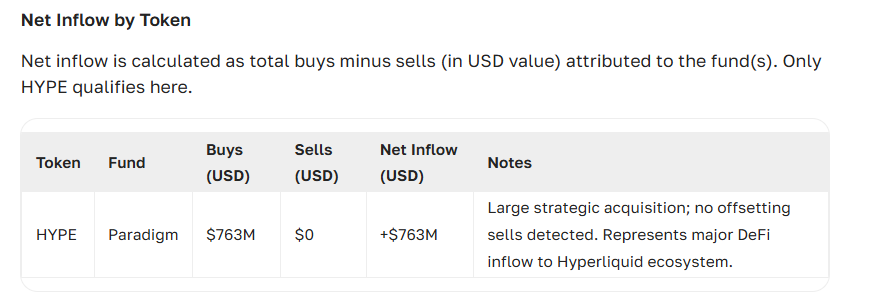

Tracking Whale Activity

When big players start shifting capital, it’s often a signal. ASCN.AI tracks those whale moves and alerts users when large buys or sells happen — giving you a head start to act before the crowd.

Step 4: Buying on a DEX (Decentralized Exchange)

Now that you’ve got crypto and a secure wallet, it’s time for the real deal — decentralized trading. DEX platforms give you full control, no middlemen.

What DEX Platforms Are (Uniswap, PancakeSwap)

DEXs are marketplaces where swaps happen directly from your wallet through smart contracts. Examples: Uniswap on Ethereum, PancakeSwap on BNB Chain.

Connecting Your Wallet

Go to the DEX site, click “Connect Wallet,” choose MetaMask, Trust Wallet, or WalletConnect, and approve the connection.

Making a Swap

The process goes like this:

-

Select your token pair (e.g., ETH → MYTOKEN).

-

Enter the amount.

-

Set your slippage tolerance — say, 0.5%.

-

Confirm the transaction and pay the gas fee.

Why Slippage and Gas Matter

Keep an eye on both:

-

Slippage — how much the price can shift during your trade.

-

Gas — the network fee. During heavy traffic, it can skyrocket.

CEX vs DEX for Beginners

Each has its perks. In short: CEX is easy, DEX is independent.

| Parameter | CEX | DEX |

| Ease of use | High (intuitive interface, support) | More complex |

| Security & control | Exchange holds your funds | You hold your own keys |

| Asset variety | Limited listings | Almost any token |

| Fees | Fixed, often higher | No platform fee, but you pay gas |

CEXs are great for learning the ropes, but DEXs give you freedom — and full control.

Wrapping Up

Moving from fiat to DEX isn’t as complicated as it seems. The key is:

-

Set up a secure wallet.

-

Buy BTC or ETH on a reliable exchange.

-

Transfer assets to your own wallet.

-

Trade carefully on DEX — always double-check what you’re buying.

Follow these steps, and you’ll minimize risks while keeping control. And if you want an extra layer of safety, AI tools like ASCN.AI can do the heavy lifting — scanning contracts, watching whales, and flagging shady moves before you get caught up in them.

Type “case” to ASCN’s bot, and you’ll get a full example of a real user–AI dialogue — a handy guide to asking smarter questions and getting better insights.

FAQ

Is it safe to keep crypto on an exchange?

Partly. It’s convenient, but risky, since you don’t control your private keys.

What’s “gas” and why do I have to pay it?

Gas is the network fee for processing your transaction (on Ethereum, BNB, etc.). Without it, nothing moves.

How do I find a token’s contract address to add it to my wallet?

Go to Etherscan or BscScan, find the token → “Contract” → copy the address → add it to your wallet manually.

What’s the minimum amount to start with?

You can begin with a small sum — just enough to cover gas fees. On Ethereum, starting with $20–50 usually makes sense.

What are the most common beginner mistakes?

A few big ones:

-

Not checking token contracts.

-

Setting high slippage.

-

Keeping everything on an exchange.

-

Ignoring gas fees.

-

Falling for scams or rug pulls.