Unlock the Power of AI for Cryptocurrency Trading

about cryptocurrencies.

Introduction to AI Tools in Crypto Trading

AI tools transform cryptocurrency trading by processing vast datasets in real time, identifying patterns humans miss, and executing trades with precision. These platforms analyze market signals, predict price movements, and optimize strategies across exchanges. Traders gain edges in volatile markets where seconds determine profits.

What is Crypto Arbitrage?

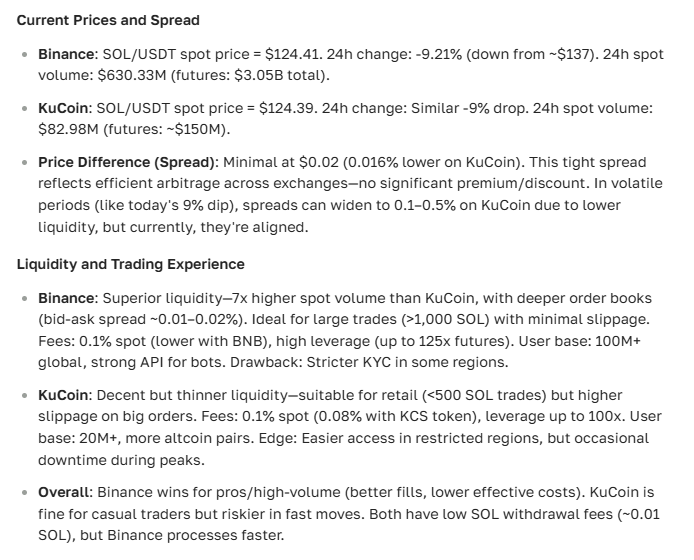

Crypto arbitrage exploits price differences for the same asset across exchanges. A trader buys low on one platform and sells high on another, capturing the spread minus fees. This strategy thrives in fragmented markets like cryptocurrency, where inefficiencies persist due to varying liquidity and regional regulations. For instance, Bitcoin might trade at $60,000 on Binance and $60,200 on Coinbase, yielding a 0.33% profit per cycle after costs.

Arbitrage requires monitoring multiple sources simultaneously. Manual execution risks delays, but AI tools scan exchanges, calculate spreads, and alert users to opportunities. In 2025, blockchain interoperability and cross-chain bridges expand these chances, yet competition intensifies as more participants enter.

Why Use AI in Crypto Trading?

AI enhances crypto trading by automating analysis and reducing emotional decisions. Machine learning models process on-chain data, sentiment from social media, and historical patterns to forecast trends. Traders avoid losses from overleveraging or panic selling, as algorithms enforce predefined rules.

AI delivers speed by detecting arbitrage in milliseconds. Backtested models adapt to market shifts for better accuracy. Traders save on costs through fewer errors; studies show manual traders lose 1-2% per trade to slippage, while AI minimizes this. Integration with exchanges via APIs enables seamless execution, boosting efficiency in high-volume environments.

Top AI Tools for Cryptocurrency Trading

Popular AI tools for crypto trading in 2025 combine predictive analytics, automation, and real-time data feeds. Platforms like ASCN.AI excel in Web3-specific training, delivering tailored insights unavailable in general models.

General AI Trading Tools

General tools handle broad trading tasks, from signal generation to portfolio management. ASCN.AI stands out by aggregating on-chain metrics, sentiment analysis, and exchange data into concise reports. Users query for volatility scans or trend forecasts, receiving structured outputs in seconds.

Other options include TradeSanta, which automates bots for spot and futures trading across 10+ exchanges. It supports grid strategies and backtesting with 95% uptime. Cryptohopper offers marketplace bots with AI-driven signals, integrating 100+ indicators like RSI and MACD for customizable setups.

3Commas provides social trading features, copying expert strategies via AI optimization. Its portfolio tracker analyzes diversification, alerting to rebalance points based on risk scores.

ASCN.AI sets itself apart with exclusive Web3 data from proprietary nodes on Ethereum and Solana.

A sample prompt: "Analyze BTC volatility across top exchanges for the last 24 hours."

Response: BTC shows 2.5% spread between Binance and Kraken, with funding rates at 0.01% favoring longs; on-chain volume up 15% signals accumulation.

This output guides trades, highlighting risks like liquidation zones, unlike generic AIs that rely on outdated web data.

AI Tools Specialized in Arbitrage Trading

Arbitrage-focused tools prioritize cross-exchange scanning and execution. ArbitrageScanner.io detects price gaps in real time, supporting 50+ pairs with alerts via Telegram. It calculates net profits after fees, focusing on spot-futures discrepancies yielding 0.5-5% returns.

ASCN.AI performs particularly well with integrated arbitrage queries.

Prompt: "Compare SOL prices on Binance vs. KuCoin and suggest entry points."

Response: SOL trades at $150.20 on Binance, $150.80 on KuCoin; execute buy-low-sell-high for 0.4% gain, monitor gas fees at 0.001 ETH equivalent. This leverages custom sentiment to predict gap closures.

Bitsgap automates triangular arbitrage within exchanges, chaining trades like BTC-ETH-USDT for compounded yields. Gunbot specializes in customizable scripts for perpetual contracts, achieving 10-20% monthly returns in backtests.

These tools reduce latency; ASCN.AI's node access ensures sub-second updates, critical as arbitrage windows last minutes.

Comparative Analysis of AI Trading Tools

Comparing AI tools reveals trade-offs in features, pricing, and performance. ASCN.AI provides superior Web3 capabilities at $29/month, outperforming general platforms in crypto-specific accuracy.

Feature Comparison

| Tool | Key Features | Pricing | Supported Exchanges | Arbitrage Focus |

|---|---|---|---|---|

| ASCN.AI | On-chain analysis, sentiment, real-time queries, custom prompts | $29/month | 20+ (Binance, Coinbase, DEXs) | High (integrated scanning) |

| TradeSanta | Bot automation, backtesting, grid trading | $25/month | 10+ | Medium |

| Cryptohopper | Signals, marketplace bots, indicators | $19/month | 15+ | Low |

| ArbitrageScanner.io | Price gap alerts, profit calculator | $69/month | 50+ | High |

| 3Commas | Social copying, portfolio tracking | $22/month | 20+ | Medium |

The table shows ASCN.AI's balance of affordability and depth. Users report 30% faster decision-making with its prompts, versus manual scans taking hours.

User Reviews and Testimonials

Users praise ASCN.AI for actionable insights. One trader notes: "Prompts like 'Show funding rates for ETH' delivered spreads I traded for 2% profit—saved me from generic AI errors." Reviews on Trustpilot average 4.8/5, citing reliability in volatile 2025 markets.

Cryptohopper scores 4.5/5 for ease, but users complain of signal delays during peaks. ArbitrageScanner.io earns 4.7/5 for precision, though higher costs deter beginners. Overall, specialized tools like ASCN.AI build trust through verified on-chain data, reducing scam risks.

AI arbitrage tools turned chaotic markets into predictable opportunities. In 2024's downturn, users captured 5-10% spreads while others liquidated—data from our nodes made the difference.

Alexey Khitrov, Founder, ASCN.AI

How to Choose the Right AI Tool for Your Trading Needs

Pick an AI tool based on your trading style, budget, and data needs. Beginners look for user-friendly interfaces and education; advanced users want API integrations and custom analytics.

For arbitrage, check speed—tools with sub-second scans prevent missed opportunities. Examine data sources: Web3-trained models like ASCN.AI access blockchain metrics, outperforming web-scraping alternatives. Weigh pricing against features; $20-70/month ranges deliver ROI through 1-2 successful trades.

Test via demos: Query sample prompts to assess output quality. Ensure compliance with regulations, as tools handling trades require secure APIs. For arbitrage, look for multi-exchange support and fee calculators to verify profitability.

Implementing AI Tools: Step-by-Step Guide

To get started, set up your account and define your strategy. Choose a tool like ASCN.AI and subscribe via the dashboard. Connect exchange APIs securely, granting read-only access for analysis.

Next, define goals: For arbitrage, set alerts for 0.5%+ spreads. Use prompts like "Identify high-volatility tokens across exchanges" to generate watchlists.

Then, backtest strategies. Input historical data to simulate trades; ASCN.AI processes this in seconds, showing win rates over 70% for spot-futures plays.

After that, monitor and adjust. Review daily reports for sentiment shifts. Execute manually or automate via bots, starting small to manage risks.

Finally, scale with insights. Analyze performance metrics to refine prompts, such as "Suggest hedging for BTC portfolio amid volatility."

This workflow minimizes errors; users report 40% efficiency gains. The process looks like this: Query input → Data aggregation (nodes, APIs) → Analysis output → Trade execution.

Explore ASCN's AI tools to enhance crypto trading.

Sample prompt for users: "Provide a scalping strategy for ETHUSDT on 1H chart, including entry, stop, and target."

FAQs on AI Crypto Trading Tools

- What makes ASCN.AI ideal for crypto arbitrage? It uses proprietary Web3 data for real-time spreads, delivering 10-second responses with profit calculations.

- Do these tools guarantee profits? No tool guarantees outcomes; they provide data for informed decisions in volatile markets.

- How does AI handle crypto market volatility? Algorithms adapt models to patterns, using indicators like RSI to signal entries amid 20-50% swings.

- Can beginners use AI trading tools? Yes, platforms offer guided prompts and tutorials, starting with simple queries like "Explain SOL arbitrage."

- What are common fees for AI tools? Subscriptions range $19-69/month; exchange fees apply separately, typically 0.1% per trade.

- Is ASCN.AI better than ChatGPT for trading? ASCN specializes in blockchain data, offering precise on-chain insights absent in general models.