Best AI crypto agents of 2025: top 10 solutions for trading and analysis — ASCN

about cryptocurrencies.

The crypto market these days is pure chaos. Coins pop up faster than you can read the whitepaper — you’re halfway through one token, and three more are already trending. Prices move like they’ve lost their minds: in the morning you’re in profit, by evening you’re staring at a blood-red chart. And the news? That just adds fuel to the fire. A single tweet, a new regulation, or some offhand remark from a politician can flip the market in minutes.

That’s where AI crypto agents come in — think of them as sleepless trading assistants. They don’t panic, don’t get tired, and couldn’t care less about FUD. Their job is simple: gather data, crunch the numbers, and whisper when it might be time to buy or sell.

What Exactly Are AI Crypto Agents?

An AI crypto agent isn’t your typical trading bot. It’s a full-blown machine learning system built to read markets, link technical indicators with on-chain data, and even interpret crowd sentiment.

In practice, that means they build trading strategies, help manage portfolios, and send out buy/sell alerts. Their main goal? Cut down analysis time and minimize risk when the market starts moving too fast for any human to keep up.

The Top 10 AI Crypto Agents for 2025

The 2025 crypto landscape is buzzing with AI tools. Every month, new bots and platforms drop — but only a handful actually deliver results. Here’s a look at ten that traders seem to trust, based on their performance, reliability, and usability.

1. ASCN.AI — The All-in-One AI Crypto Assistant

ASCN isn’t just another bot. It’s more like your personal AI analyst — connecting token analytics, on-chain metrics, and real-time forecasts into one chat-based dashboard. You ask a question, it gives you structured insight. It handles DeFi, NFTs, and even emerging projects. Simple enough for beginners, powerful enough for pros.

And if you don’t feel like combing through endless dashboards — ASCN.AI can pull the numbers and make sense of them in seconds.

2. Kryll — Visual Strategy Builder

Kryll runs on a drag-and-drop system. You build strategies like Lego blocks, no coding needed. You can backtest against historical data, then deploy in real markets through API connections. Great for tinkerers who enjoy building and testing their own trading logic.

3. TradeSanta — Plug-and-Play Automation

This one’s for traders who don’t want to mess with complex setups. Choose a template, tweak a few options, and let it run. It works with major exchanges, supports both spot and futures, and even comes with a mobile app. Basically, trading on autopilot.

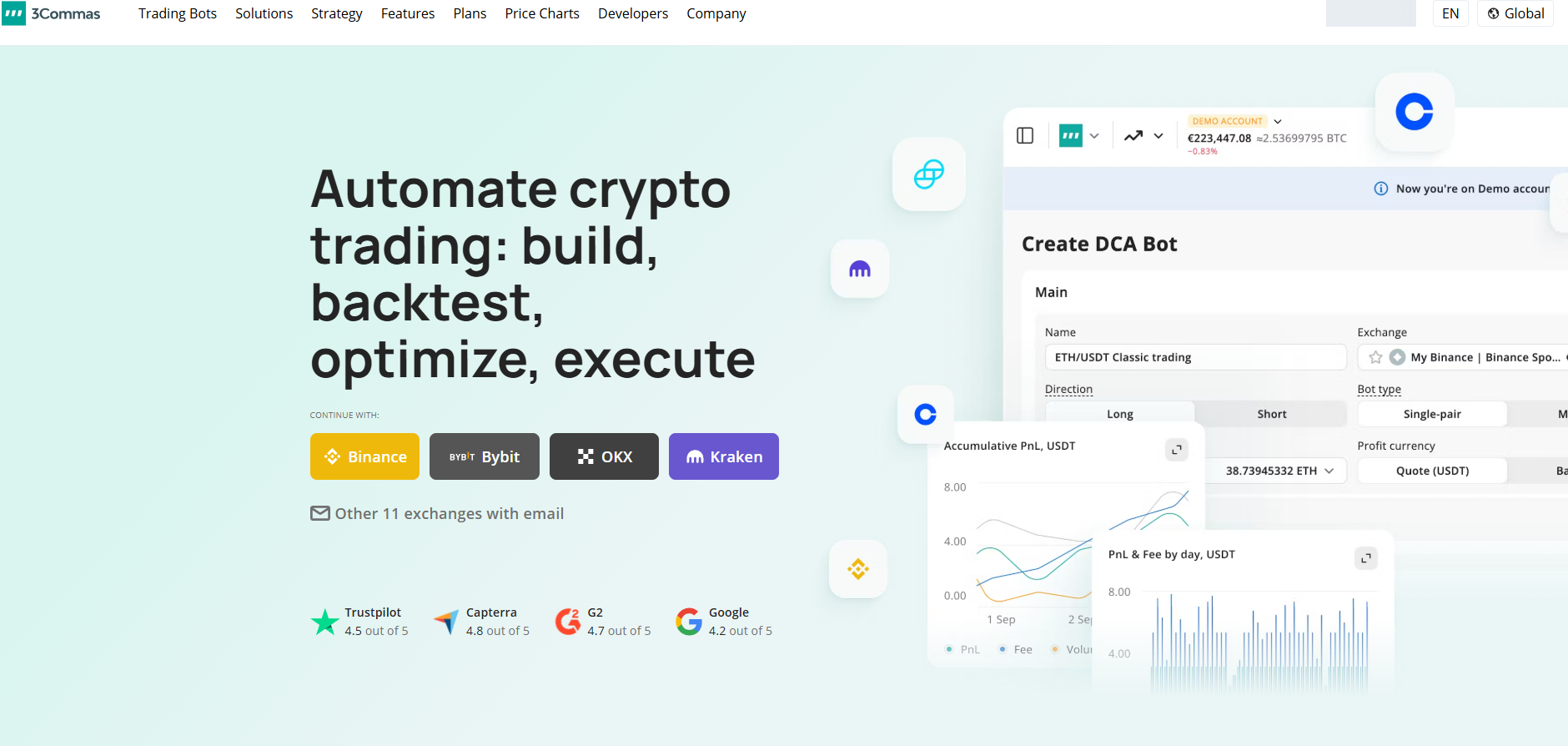

4. 3Commas — The Veteran With AI Optimization

3Commas has been around for years, and it keeps evolving. It’s known for SmartTrade, DCA, GRID bots, and social copy trading. Lately, it added AI optimization — strategies that adapt automatically to market changes. You can mirror top traders or fine-tune your own mix of manual and automated moves.

5. Coinrule — No-Code Strategy Builder

Coinrule is all about simplicity. You set your trading “rules” using plain language — no coding required. The platform supports dozens of exchanges (Binance, Bybit, Coinbase, etc.) and even includes a strategy library to get you started fast.

6. Bitsgap — Arbitrage Meets AI

Bitsgap blends trading, arbitrage, and portfolio management in one dashboard. In 2025, it rolled out an AI-driven prediction model for short-term price moves — a solid fit for active traders. It’s not the easiest tool to master, but it’s packed with depth.

7. Pionex — Built-In Bots, Low Fees

Here, everything’s baked into the exchange. Sixteen ready-to-go strategies, no extra setup, and some of the lowest fees in the business. You don’t even need to worry about API keys — it’s native. Perfect for those who just want to plug in and go.

8. Stoic AI — The Long-Term Investor’s Choice

Created by Cindicator, Stoic isn’t chasing quick trades. It builds and manages a portfolio using AI models that factor in crowd sentiment and long-term trends. Works via Binance API. Great for those who prefer a “buy, hold, and chill” approach.

9. Napbots — Strategies From the Pros

A French-made platform that offers subscription access to professional algorithms. You pick a strategy, connect your exchange, and let it trade automatically. Recent updates include seasonal and network-metric-based models. Everything runs in real time.

10. Shrimpy — AI-Powered Portfolio Management

Shrimpy focuses on automated rebalancing and social trading. It lets you mirror big players, track signals, and manage multiple assets in one interface. A good match for traders who think long-term and value data-driven portfolio control.

So What Can These Agents Actually Do?

Modern AI crypto agents are far from simple bots. They can:

-

Trade automatically based on market signals

-

Analyze charts, blockchain data, and even social media chatter

-

Generate trading signals for entry and exit points

-

Rebalance portfolios in real time

-

Evaluate tokenomics and discover promising new assets

Basically, they combine the jobs of an analyst, a risk manager, and a trader — all rolled into one.

Why Bother With AI in Crypto?

Speed. That’s the number one reason. While a human is still opening TradingView, AI has already scanned thousands of metrics and built a prediction model.

Then comes emotion — or rather, the lack of it. No fear, no greed, no revenge trading. Just logic.

And of course, automation. These systems can track whales, read on-chain movements, and even monitor social signals while you sleep. The result? Less time staring at screens, more time making decisions that actually matter.

But Let’s Be Real: There Are Risks

No algorithm is a money printer. The accuracy of any AI model depends on the data it’s trained on. If the data’s messy, the signals will be too.

Technical hiccups are also a thing — API failures, exchange delays, or bad updates can easily lead to losses.

And don’t forget trust: you’re giving access to your trading account. So unless the platform has airtight security — encryption, API key limits, and audits — even the smartest bot won’t save you.

Bottom line: AI agents amplify your edge, but they don’t replace you.

How to Choose the Right AI Crypto Agent

There are dozens of platforms out there, all promising “revolutionary automation.” Most aren’t. To find the real deal, look at what actually matters.

Adaptability and Automation Level

A solid AI system doesn’t just follow orders — it reacts to changing markets. Some require user confirmation for every move, others self-adjust in real time. If a bot can’t evolve with new trends, it’s just a calculator pretending to be smart.

Exchange and Token Support

Always check which platforms it connects to. Some only work with Binance or Bybit, while others plug into both centralized (CEX) and decentralized (DEX) exchanges. The broader the coverage, the more flexibility you get — especially if you’re trading newer projects like Zerebro, Fartcoin, or Swarms.

Forecast Accuracy and Strategy Performance

This one’s crucial. Markets move fast, and AI must learn constantly. The best systems retrain on fresh data and publish transparent performance stats. If a platform hides its numbers — that’s a red flag.

Data Security and API Access

Encryption, flexible API key permissions, two-factor authentication — all must-haves. Without them, you’re basically handing your funds to chance. No trading edge is worth a security hole.

Interface and Ease of Use

A complex system shouldn’t feel complicated. Good UX, solid documentation, and clear customization options make all the difference. For advanced users, API integrations and third-party app support are a big plus.

Quick Comparison: Features, Price, Highlights

| Platform | Exchange Support | Key Functions | Price | Highlights |

| ASCN.AI | Direct node, DEX, Web3 sources | Token analytics, on-chain metrics, whale tracking, AI bot builder | from $29/mo | <10 sec responses, real blockchain data, AI crypto chat assistant |

| Kryll | Binance, KuCoin, OKX | Visual editor, strategy marketplace | from $4.99/mo | Drag-n-drop builder |

| TradeSanta | Binance, Huobi, HitBTC | Templates, auto-trading, Telegram bot | from $18/mo (free plan) | Beginner-friendly |

| 3Commas | Binance, Kraken, Bitstamp | SmartTrade, copy trading, DCA, AI optimization | from $49/mo (free plan) | Pro analytics, trailing orders |

| Coinrule | Binance, Coinbase, Bitfinex | No-code rules, templates | from $29/mo (free plan) | 250+ strategies, interactive learning |

| Bitsgap | Binance, Bybit, OKX | Arbitrage, grid bots, portfolio tools | from $22/mo | Futures & DEX data |

| Pionex | Built-in exchange | 16+ bots including AI Grid | Free | Ultra-low fees |

| Stoic AI | Binance | Portfolio management via AI | from $9/mo | Created by Cindicator |

| Napbots | Binance, OKX, Bitfinex | Ready-made pro strategies | from €9/mo | Quant-team product |

| Shrimpy | Binance, Kraken, Gemini | Rebalancing, AI optimization | from $19/mo (free plan) | Social signals, automation |

The Pros and Cons of AI Crypto Trading

AI agents are here to stay — but they’re not magic.

Pros

Speed, efficiency, and automation. They run 24/7, skip the emotional rollercoaster, and save you hours every week. They can multitask — scanning data, tracking whales, and rebalancing — while you focus on bigger-picture strategy.

Cons

Market risk never disappears. Algorithms make mistakes, exchanges lag, updates break things. And yes, you’re trusting someone else’s system with your account access.

AI is a tool — a powerful one — but it still needs a human touch to make it work.

Who Should Try AI Crypto Agents (and How to Start)

AI in crypto isn’t just for “tech elites” anymore. Anyone can use it — from newcomers to high-frequency traders juggling dozens of positions. The trick is knowing what you actually need.

For beginners:

Start simple. ASCN.AI is perfect if you want to ask questions and get quick insights in plain language. TradeSanta and Coinrule are great if you prefer templates and minimal setup. You click a few buttons, connect an exchange, and you’re good to go.

For advanced traders:

Flexibility is key. Kryll, 3Commas, and Bitsgap let you build and customize strategies with API-level control. You can backtest, tweak, and combine models to suit your own trading logic — like having an adaptive assistant that learns your style.

Picking the Right Bot for You

If you want a hands-off, fast-learning assistant — go for ASCN.AI.

For long-term portfolio growth — Stoic AI or Shrimpy.

Looking for arbitrage and active plays? Bitsgap will give you tools to dig deep.

And don’t forget the budget. Subscriptions start around $5 a month and can go past $50 depending on features. Choose wisely based on how often you trade and how much automation you actually want.

Can You Really Trust AI in Crypto Trading?

AI in crypto isn’t a “get rich” button. It’s a force multiplier — it helps you see more, react faster, and make cleaner decisions. But it’s still just a tool.

Where AI shines: routine. Executing orders, tracking news, monitoring whale wallets — it’s unbeatable there.

Where humans win: intuition, context, and gut feel. AI doesn’t sense the crowd mood or politics behind a market swing.

So the best formula? Let the bot handle the grind while you focus on strategy.

The Winning Combo: Human + AI

Here’s what works best: you set the direction, and your AI agent handles execution. You decide which assets to trade, define your targets, and let the algorithm do the heavy lifting — entries, exits, rebalancing.

That partnership — speed plus judgment — is where real alpha lives. The trader provides the vision, the AI delivers precision.