Bear Market and Bull Market in Cryptocurrency.

about cryptocurrencies.

Market Overview

News, economic factors, and investor behavior shape the cryptocurrency market. Currently, elements of both bullish and bearish trends are present, and asset prices respond to global events. During periods of growth, cryptocurrencies attract new participants, while in times of decline, investors seek to preserve their capital.

Current Trends

The cryptocurrency market is experiencing mixed dynamics: a bullish trend prevails for certain assets, such as Bitcoin, where prices are rising due to institutional investments, while a bearish trend is impacting altcoins, pushing them below yearly lows. Volatility is high—prices can fluctuate by 10-20% within a day. Traders are monitoring trading volumes to understand the direction of the trend. ASCN.AI collects on-chain metrics and news to identify shifts.

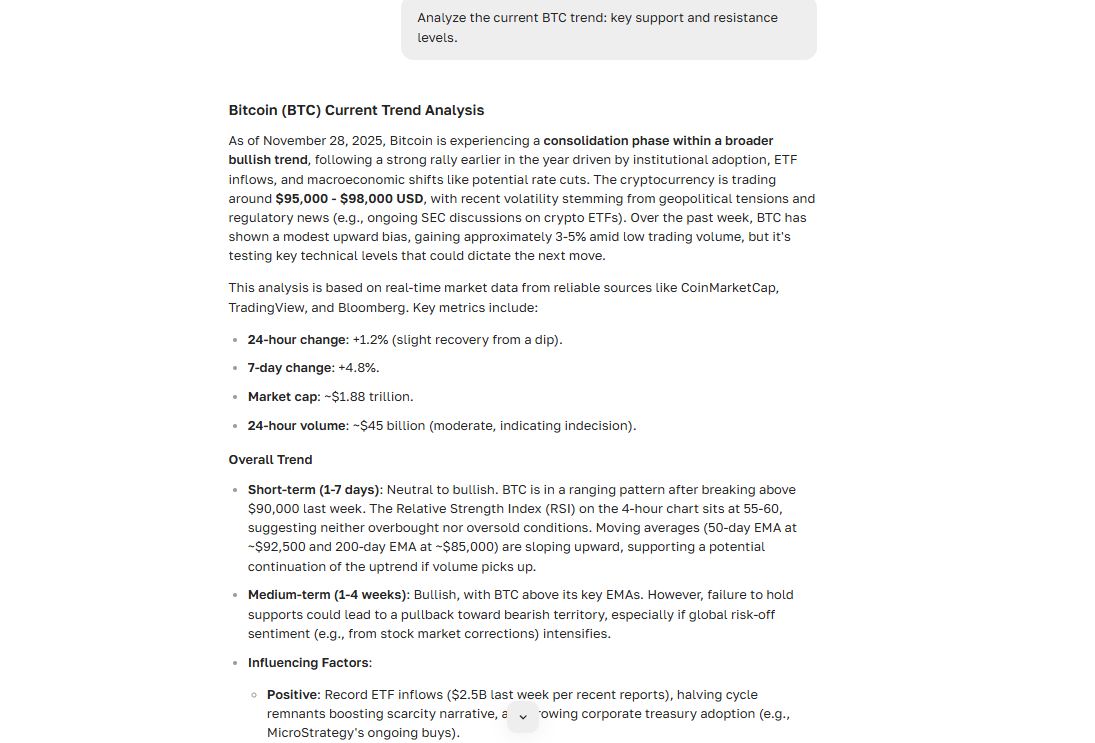

Analyze the current BTC trend: key support and resistance levels" outputs support levels around $60,000 and resistance levels around $70,000, which helps in planning entry into a position

Data for 2025 links the growth of cryptocurrencies to the integration of AI in trading. Investors are monitoring volumes on exchanges to predict price movements. A bearish trend manifests in corrections after peaks, when prices fall below the 50-day moving average. Conversely, a bull market shows consistent growth above this line, attracting additional capital.

The Role of the Year in Cryptocurrency Dynamics

Annual cycles define the dynamics of cryptocurrencies, including bull and bear markets. In 2025, the market is recovering from past declines, with investments increasing amid regulatory shifts. Each year brings new patterns: growth at the beginning of the cycle and correction by the end. In a bullish year, cryptocurrency prices outpace inflation; in a bearish year, they fall below expectations.

ASCN.AI tracks annual patterns through the prompt "Compare the dynamics of cryptocurrencies in 2024 and 2025: key events and their impact on prices," generating a report with graphs—showing a 150% increase in Bitcoin and a 40% decline in altcoins—which allows investors to adjust their strategies.

Aspect 2024 2025 (YTD) Key Differences/Insights Overall Market Trend Explosive bull run; high speculation Consolidation with selective rallies 2024: Retail-driven hype (e.g., memes +300%). 2025: Institutional focus, slower growth due to macro caution. Volatility High (60-90%); sharp rallies/dips Moderate (40-50%); more predictable ranges 2024 events like halving amplified swings; 2025's regulatory wins provided stability but fewer catalysts. Key Drivers Halving, ETF launches, upgrades Regulations, corporate adoption, AI integrations 2024: Supply shocks (halving). 2025: Demand-side (ETFs +$35B total inflows vs. 2024's $15B). BTC Price Impact +150% (ATH $108K); halving-led surges +20% (ATH $110K, now $96K); election boosts 2024: Breakout from bear market. 2025: Testing resistances; potential for $120K if rates cut. ETH/Altcoin Impact ETH +90%, alts +100-300%; DeFi boom ETH +10%, alts +20-80%; sector rotation 2024: Broad gains. 2025: Narrower (AI/DeFi outperform memes); SOL/ETH competition intensifies. Regulatory Influence Mixed (approvals vs. bans); MiCA/FIT21 Positive (pro-crypto policies); stablecoin clarity 2024: Reactive to scandals. 2025: Proactive, reducing uncertainty but slowing innovation. External Factors Rate cuts, Mt. Gox repayments Elections, geo-tensions, exchange hacks Both tied to macros, but 2025 shows higher stock correlation, amplifying downturns. Adoption Metrics ETF inflows $15B; TVL $150B ETF inflows $20B; TVL $200B; corporate holdings up 50% Steady progress; 2025 emphasizes real-world use (e.g., remittances via stablecoins). At the beginning of the year, it is advisable to focus on long-term investments, while by the end, one should take profits. News about Bitcoin's halving strengthens the bullish trend, while geopolitical events provoke a bearish one.

Trend Analysis

To analyze trends in the cryptocurrency market, bullish and bearish periods are taken into account. A bullish trend drives prices upward, attracting investors, while a bearish trend causes a decline and capital redistribution. Traders study charts: higher highs indicate a bull run, while lower lows indicate a bear market.

Bullish Trend

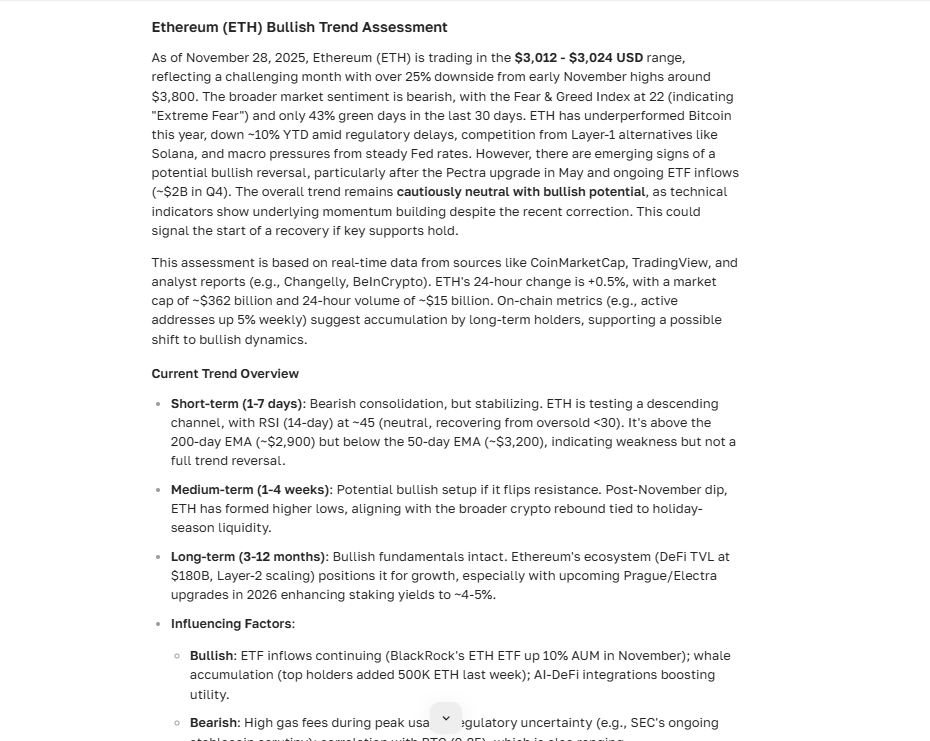

In a bullish trend, cryptocurrency prices consistently rise above previous peaks— for example, Ethereum may increase by 200% over a period. Investors buy during dips, anticipating further upward movement. Trading volumes increase, and news about partnerships fuels interest. Strategies are focused on buying during corrections to capitalize on the growth.

ASCN.AI evaluates sentiment through the prompt "Assess the bullish trend of ETH: buy signals and price targets," providing data: an RSI below 70 signals a rally to $5000 with a risk of a 10% pullback. This helps traders timely secure profits.

The bull market lasts for months, with cryptocurrency prices outpacing traditional assets. Institutional investments push the market capitalization above $3 trillion.

Bear Trend

The bear trend drives prices below key levels—cryptocurrencies lose 50-80% from their peaks, as seen in 2022. Investors reduce their positions, opting for assets with a strong fundamental basis. Volatility increases, and selling predominates. The bear market filters out weak projects, preparing the ground for the next bull cycle.

ASCN.AI assists with the prompt "Analyze the bear trend of SOL: support levels and hedging strategies," providing support at $100 and a recommendation for short positions with targets at $80 to minimize losses. Traders use such insights to protect their capital.

In a bear trend, risks increase, but opportunities for undervalued assets arise. A drop below the 200-day moving average confirms the continuation of the decline.

Strategic Approach

Cryptocurrency investment strategies depend on the market phase: aggressive in a bull trend and conservative in a bear trend. Investors diversify their assets, weighing risks and opportunities for long-term growth.

Optimal Strategies for Investors

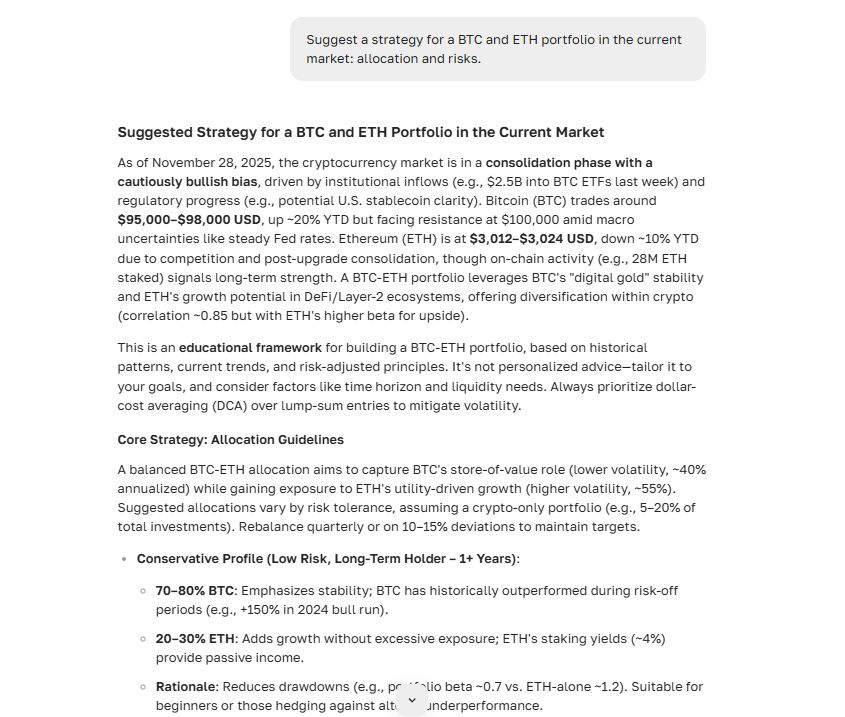

For investors, dollar-cost averaging is suitable in a bull market, while hedging is advisable in a bear market. During an uptrend, buy on dips, distributing funds across top assets. In a downturn, convert profits into stablecoins.

ASCN.AI optimizes the prompt approach "Suggest a strategy for a BTC and ETH portfolio in the current market: allocation and risks," responding: 60% in BTC for stability, 40% in ETH for growth, with quarterly rebalancing — this reduces volatility by 25%. Such a tool simplifies planning.

Adapt strategies to the period: short positions in a bear trend, long positions in a bull trend. Diversification across 5-10 assets reduces risks.

Risks and Opportunities

In the crypto market, risks include sharp price drops and regulatory changes, while opportunities lie in the growth of new projects. In a bull trend, altcoins offer potential, while in a bear trend, buying at the bottom is advantageous. Volatility brings losses but also profits for prepared investors.

ASCN.AI identifies risks with the prompt "Assess the investment risks in ADA: on-chain signals and sentiment," indicating that whale activity is a signal for growth, but there are threats from token unlocks. Analyzing such reports helps avoid losses.

Stop-losses minimize losses, paving the way for profits during recovery.

Forecasts and Analytics

Cryptocurrency forecasts are based on the analysis of trends and external factors. A bullish scenario sees prices rising above current levels, while a bearish scenario anticipates a drop below them. Analytics combines data on prices, volumes, and news for accurate assessments.

Impact of Political Decisions

Political decisions directly affect the cryptocurrency market: regulations in the U.S. spur a bullish trend, driving prices up. In 2025, ETF approval boosts investments, while restrictions lead to a bearish decline. Positive news can elevate Bitcoin by 30%.

ASCN.AI monitors the prompt "Analyze the impact of Trump's policies on the cryptocurrency market: BTC price forecast," providing: a rise to $100,000 with support, and a risk of a 20% correction with tightening. Traders adjust their strategies based on such data.

Global policies set the pace: liberalization accelerates growth, while restrictions slow it down.

Technological Trends

Technologies like AI in blockchain are driving the market upward. The integration of smart contracts raises cryptocurrency prices above historical highs. By 2025, DeFi and NFTs are evolving, creating new assets. A bearish trend impacts outdated technologies.

ASCN.AI provides analytics with the prompt "Forecast the impact of AI on cryptocurrencies: top trends and assets," responding with a projected 150% increase in AI project tokens, focusing on Fetch.ai. This directs investments into promising areas.

Trends shape the future: Ethereum updates strengthen positions, and innovations attract capital.

FAQ and General Questions

The FAQ covers basic aspects of the crypto market, helping newcomers and traders understand strategies for bullish and bearish trends.

Questions from Newcomers

What is a bullish and bearish market in cryptocurrency? A bullish market is characterized by rising prices above past levels, while a bearish market involves falling prices below those levels. They dictate investment strategies.

How to start investing in cryptocurrencies? Choose an exchange, create a wallet, and invest in top assets. ASCN.AI simplifies this: the prompt "Step-by-step: how to buy BTC for beginners" provides instructions along with risks.

What are the risks in a bearish market? Prices can drop by 50% or more, but this presents an opportunity to buy at the bottom.

Tips for Traders

How to identify the start of a bullish trend? Look for increased volume and prices above the 200-day moving average. ASCN.AI can assist with analysis.

What strategies work in a volatile market? Hedging and diversification are key. The prompt "Strategy for a volatile market: examples for ETH" offers long/short scenarios.

How do news events impact prices? Positive news lifts the market, while negative news pulls it down. Monitor through AI agents from ASCN.AI for timely reactions.

For detailed analysis, use AI crypto agents from ASCN.AI. Learn more about basic concepts in cryptocurrency.